Trading recommendations for the EUR / USD pair on September 25

Analysis of transactions

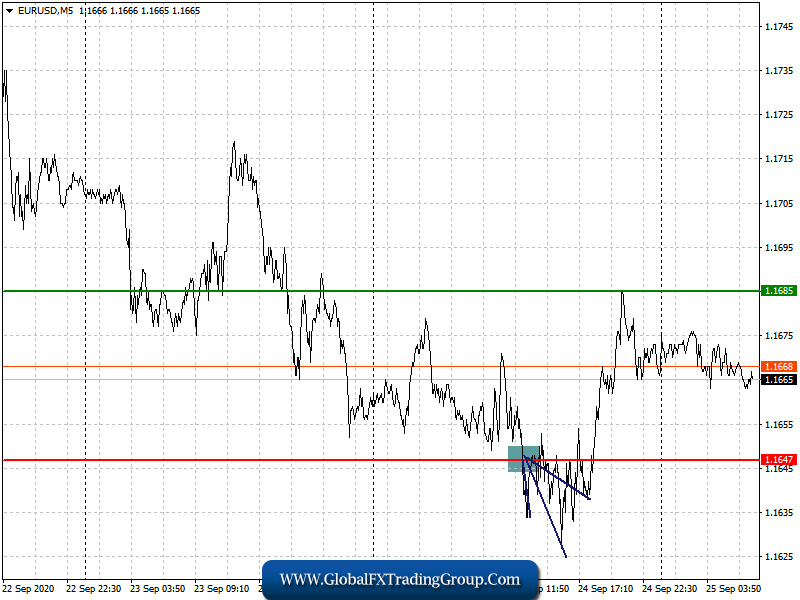

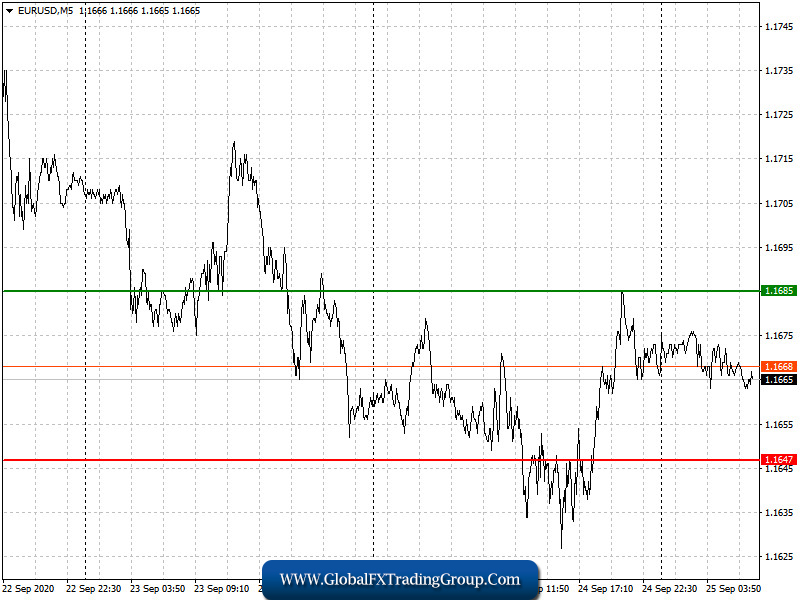

The bears failed to trigger a large decrease in the EUR / USD pair yesterday, so as a result, short positions in the market only brought about 20 pips of profit. Nevertheless, the priority is still on sales, since weak reports for Germany put pressure on the European currency.

Today, the euro may rise on the grounds that upcoming reports or statements by the authorities do not serve as an impetus for depreciation. Otherwise, the quotes will close in a sideways channel, at 1.1647-1.1685 in particular, without forming a good upward correction.

Buy positions when the quote reaches a price level of 1.1685 (green line on the chart). However, a huge price increase is not really expected today. Thus, take profit at the level of 1.1758. Sell positions after the quote reaches the level of 1.1647 (red line on the chart). A breakout and consolidation below this level could lead to another large drop in the euro. Take profit at the level of 1.1586.

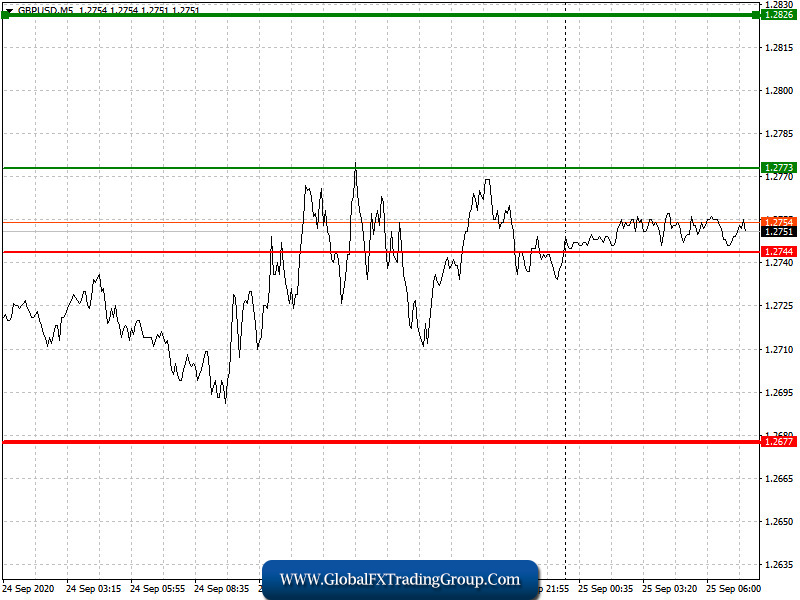

Trading recommendations for the GBP / USD pair on September 25

Analysis of transactions

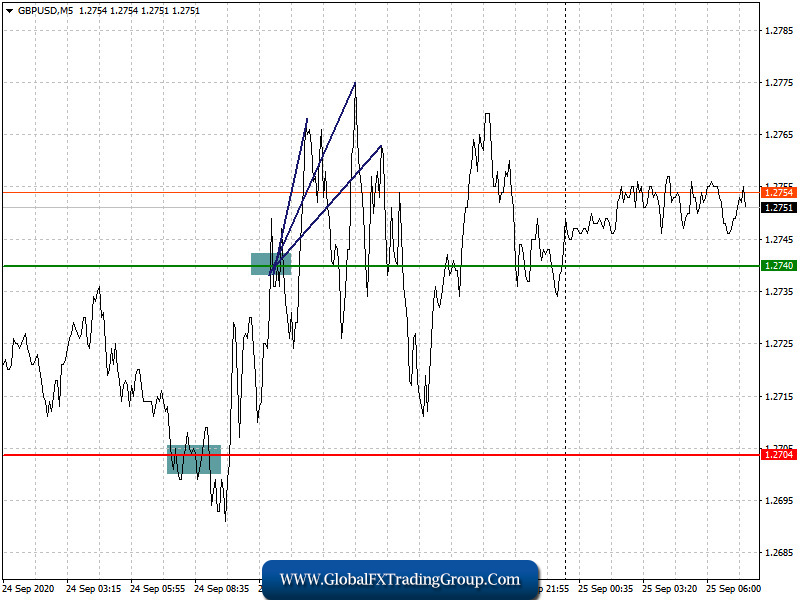

Major players were absent in the market yesterday. Thus, short positions from 1.2704 did not lead to the desired downward movement in the GBP / USD pair. Meanwhile, in the afternoon, long positions from 1.2740 became very profitable, as growth in the pound to about 35 pips.

As there are no important statistics today, it is likely that the pair will remain in a sideways channel that it has been in over the past few days. An upward correction could occur though, after a huge drop in quotes this week.

Buy positions when the quote reaches a price level of 1.2773 (green line on the chart). Take profit at the level of 1.2826 (thicker green line on the chart). Sell positions after the quote reaches the level of 1.2744 (red line on the chart). Take profit at the level of 1.2677.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom