Trading recommendations for the EUR / USD pair on September 30

Analysis of transactions

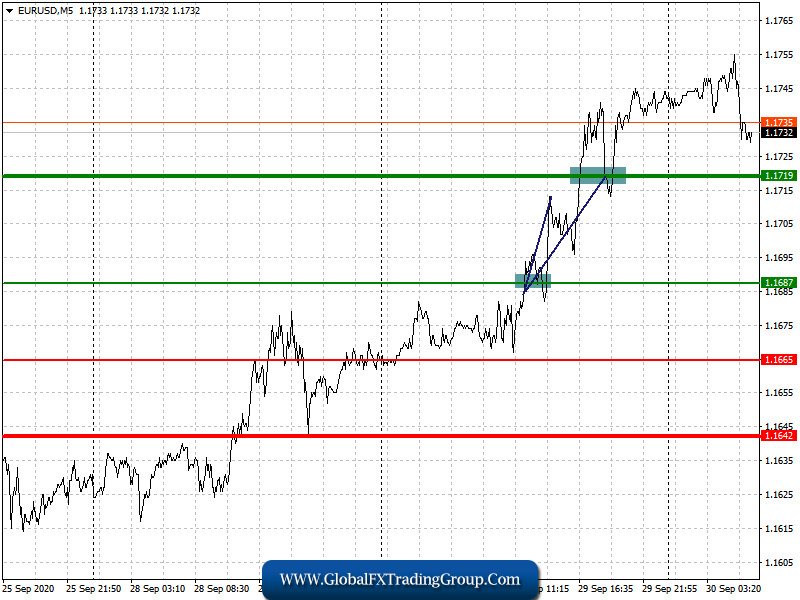

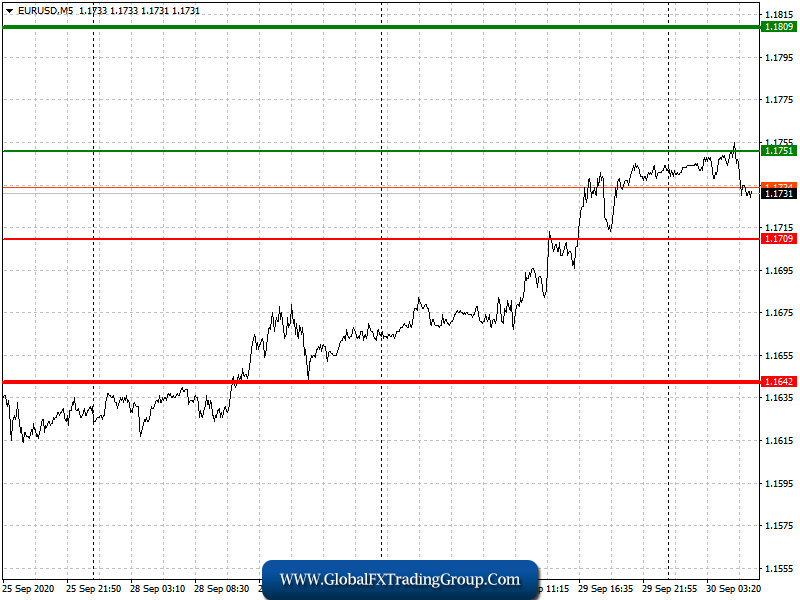

Good data on the Eurozone economy led to a rather decent growth in the European currency, during which the quote rose about 25 pips from the level of 1.1687. Key indicators, despite the recent surge in coronavirus infections, have shown promising improvements, signaling good economic recovery.

Today, more economic data are due to be published, and they may more or less support the euro on rising in the markets. However, ECB president Christine Lagarde will also discuss today the EU monetary policy, and whatever stance she delivers, it could impact demand in the market as well.

Buy positions when the euro reaches a price of 1.1751 (green line on the chart), and take profit at the level of 1.1810. If Lagarde does not announce future changes in the monetary policy, the euro will continue to climb up in the markets. Sell positions after the quote reaches the level of 1.1709 (red line on the chart), and take profit at the level of 1.1642. If Lagarde talks about easing the monetary policy, pressure on the euro will return.

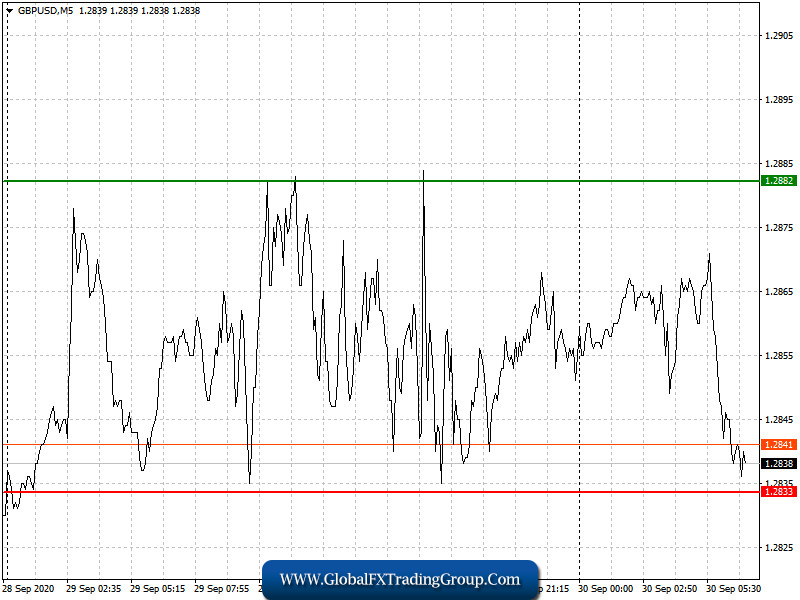

Trading recommendations for the GBP / USD pair on September 30

Analysis of transactions

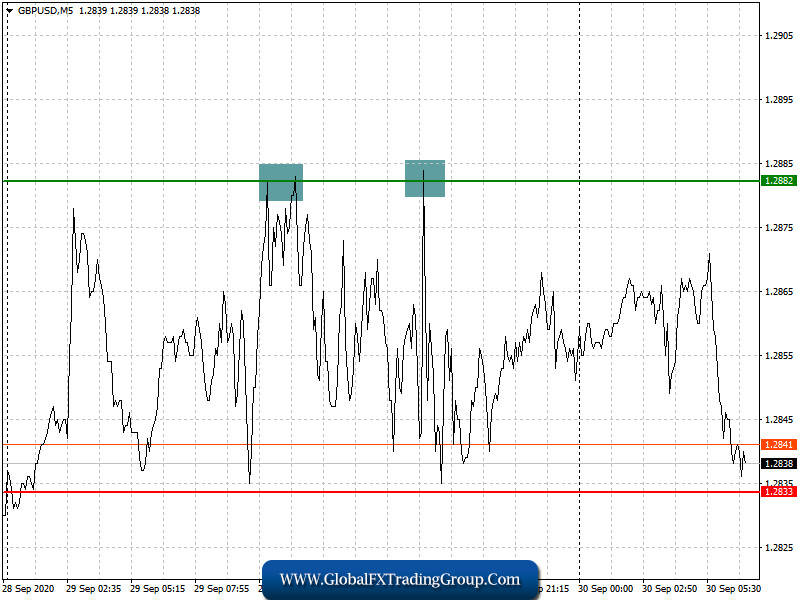

The pound, trading in a flat yesterday, brought losses to traders regardless of the position they were into.

But today, the bears may get ahold of the market, especially since the UK Parliament has approved the controversial internal markets bill proposed by Boris Johnson, which erases all the previously reached agreements between the UK and EU. This may result in more tension between the two countries, and could accordingly bring the pound to a sharp decline.

Buy positions at a quote of 1.2882 (green line on the chart), and then take profit at the level of 1.2945 (thicker green line on the chart). Sell positions after the pound reaches a price of 1.2833, which could happen on the grounds of a tough reaction and retaliatory political sanctions from the EU (red line on the chart). Then, take profit at the level of 1.2763.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom