EUR / USD

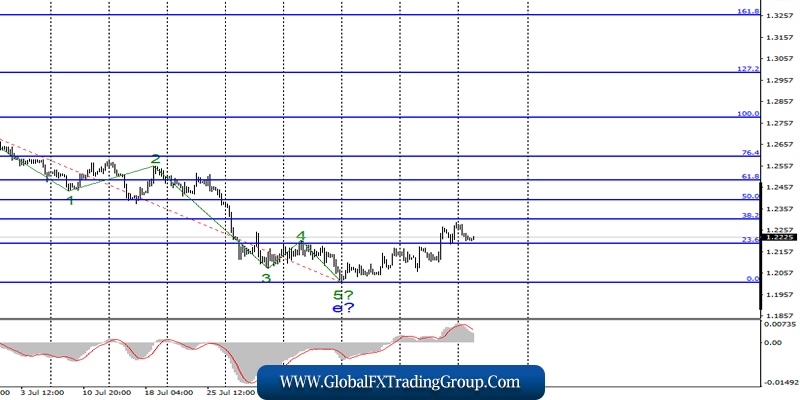

Monday, August 26, ended for the EUR / USD pair with a decrease of 40 basis points. The demand for the US currency has recovered, despite the fact that the wave pattern implies the continuation of the construction of the upward wave c.

However, not everything is lost. Yesterday’s decline of the euro-dollar pair can be interpreted as building an internal wave 2 in the future c. If this is true, then the increase will resume with targets located above the level of 1.1250 today or tomorrow. Although, the growth above this level is in great doubt. I have repeatedly drawn attention to the news background, which does not at all imply a strong appreciation of the euro along with the dollar.

From time to time, markets get good reports from America and weak ones from the eurozone. If it weren’t for a trade war with China, the American economy would have felt even better. It is difficult to imagine where would the euro be now. However, there is a negative impact from the conflict with Beijing, which leads to the need to soften the monetary policy of the Fed and hinders the growth of the US currency.

For today, I will wait for an indicator of consumer confidence in the United States. Its decline relative to the figure of 135.7 will support the euro.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has supposedly completed the construction of wave b. I recommend buying a pair with targets above the level of 1.1250. I recommend selling the instrument not earlier than receiving confirmation of the market’s readiness to build a new downward set of waves.

GBP / USD

On August 26, the pair GBP / USD lost 65 b.p, but left the current wave marking, which suggests the construction of at least a correction set of waves, unchanged. Throughout the entire section of the trend, which started on August 12, pullbacks were an integral part.

Also, how could it be otherwise, if the events in the UK should send the pound to new minimums but instead, the British currency is still rising? The EU has officially announced that there will be no new negotiations on an agreement on Brexit, and if Boris Johnson refuses to pay the $ 50 billion provided for Brexit, the EU will not stand aside and take action.

For example, refusing all agreements reached with Theresa May and providing for relations between the EU and Britain after Brexit. Let me remind you, Boris Johnson stated earlier that the UK will not be obliged to repay a multi-billion dollar debt if Brussels refuses to make a deal. In general, the relations between the EU and Britain are heating up.

Thus, I look forward to new speeches by representatives of these states, but now, it is unlikely worth counting seriously on the fact that Brexit will be “soft”.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2306 – 38.2% Fibonacci

1.2401 – 50.0% Fibonacci

General conclusions and trading recommendations:

The downward section of the trend is previously considered completed. Thus, now, it is expected to build an upward trend correction section with the first goals located near the calculated levels of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom