EUR / USD

On December 19, the EUR / USD pair completed with an increase of several base points, which does not affect the current wave marking in any way again, which still involves the completion of the ascending 3-wave trend section near the Fibonacci level of 100.0%.

At the same time, the probability of complicating the upward trend section and its transformation into a 5-wave one with the prospect of leaving much higher than 12 figures remains until a successful attempt to break through the 61.8% Fibonacci level.

Fundamental component:

There was practically no news background for the euro-dollar instrument on Thursday. This explains the weak activity of the currency market and the inability of the instrument to continue to decline below the level of 61.8% Fibonacci or to start building wave 5.

Moreover, there was only data from the US Department of Labor on applications for unemployment benefits. The total number of which amounted to 234,000, which is slightly higher than market expectations.

There was also data on sales in the secondary housing market in November, which also turned out to be slightly worse than forecasts. Today, there will be several interesting economic reports in America that will undoubtedly attract the attention of the market.

First of all, we are talking about the report on GDP for the third quarter. According to market expectations, GDP should increase by 2.1%, and any value below this will be regarded as negative for the dollar. In addition, markets will closely monitor data on personal income and expenses of the American population, which should grow by 0.3% and 0.4%, respectively.

You should also pay attention to the University of Michigan consumer confidence index, which may exceed the value of November 99.2. Thus, these three reports will be called upon today to help the US dollar reach breaking through the 61.8% Fibonacci, which will allow markets to continue to participate in the construction of a new downward trend.

General conclusions and recommendations:

The euro-dollar pair presumably completed the construction of the upward trend section. Thus, I would recommend buying an instrument with targets near the calculated levels of 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci, only in case of a successful attempt to break through the level of 100.0%.

At the same time, I also recommend selling the instrument after a successful attempt at a breakthrough of 1.1109, which will confirm the willingness of the markets to continue selling Eurocurrencies.

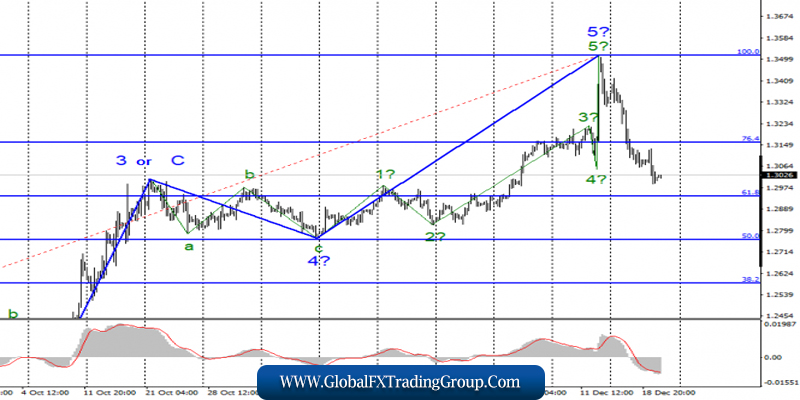

GBP / USD

On December 19, GBP / USD pair lost another 70 basis points and, thus, continues to build the proposed bearish section of the trend and its wave 1 or a. Thus, the decline in quotes of the instrument can continue today, on Friday, with targets located around 61.8% Fibonacci.

On the other hand, the upward trend section is currently considered complete. Therefore, I expect to see at least a three-wave descending wave structure. However, an unsuccessful attempt to break through the 61.8% Fibonacci level may lead to the start of building wave 2 or b.

Fundamental component:

On Thursday, the news background for the GBP / USD instrument was very important. The Bank of England meeting, which is the last for 2019, was designed to answer the question “when is the Central Bank preparing to change its key rate?” Many believed that a reduction to the level of 0.5% would be carried out in the coming months, and thus, someone believed that the rate should not be reduced. In addition, the Bank of England itself has taken the most neutral position, and its accompanying statements can be interpreted as you like.

In turn, representatives of the Central Bank did not give a clear answer to the question of when to expect changes in monetary policy. It was only noted that economic reports in the UK do have a tendency to decline and this worries the members of the monetary policy committee.

However, nothing less exciting is the upcoming Brexit uncertainty, related to future negotiations between London and Brussels on various agreements, in particular trade, which will determine the relationship between them after Brexit.

The Bank of England is also worried about possible new trade wars or an escalation of existing ones that have a negative impact on the entire world economy and the UK economy in particular. Thus, the British Central Bank took a wait-and-see position and intends to intervene only in case of emergency.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, I recommend continuing to sell the instrument with targets near 1.2950, which roughly corresponds to the 61.8% Fibonacci level. The departure of quotes from the reached lows in the framework of building correctional wave 2 can be considered for the possibility of new sales of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom