EUR / USD

On February 27, the EUR / USD pair immediately added 120 points and continued to push off quotes from the previously reached lows, as well as building a new upward wave, possibly 4 in the downward part of the trend, or 1 in the new upward one.

After yesterday’s strong increase in the Euro currency, I am even inclined to believe that the downward trend section, starting on December 31, took a three-wave form and completed its construction. The previous few sections of the trend were also three-wave. Thus, it is highly probable that the pair is now building wave 1 and in the near future will be building wave 2 with targets located about 9th figure.

Fundamental component:

The news background for the EUR / USD instrument on February 27 was quite interesting. There will be reports on orders for durable goods in the US, as well as preliminary data on US GDP for the fourth quarter. However, markets are currently not paying attention to the economic statistics, but to extraordinary events in the world.

Despite the fact that the levels of coronavirus infection cannot yet be called high, it still continues to spread throughout the world. The governments of the countries in which the mass infections occurred, of course, declare quarantine, which negatively affects the production and simply the activities of many firms, companies and corporations.

The most acute problem is, of course, in China, where the whole region and other regions are quarantined. Accordingly, business activity, production, and demand for raw materials and energy is declining, which leads to a whole host of other problems. The main of which is the slowdown of the economy. In this regard, the oil collapsed yesterday to $ 45 per barrel, as well as US stock indices.

I can’t say that the collapse of stock markets caused the dollar to decline. Moreover, it decreases only in the EUR / USD instrument, and, for example, with the pound sterling, it increases. Nevertheless, the state of the currency market cannot be called stable and normal now. Some panic is already present.

General conclusions and recommendations:

The euro-dollar pair has allegedly begun the construction of a new ascending section. Based on the current wave counting, I recommend waiting for the completion of waves 1 as well as 2, and using MACD signals to buy euro currency within wave 3. The upward trend section began quite abruptly, and the wave pattern now does not have a completely unambiguous view.

GBP / USD

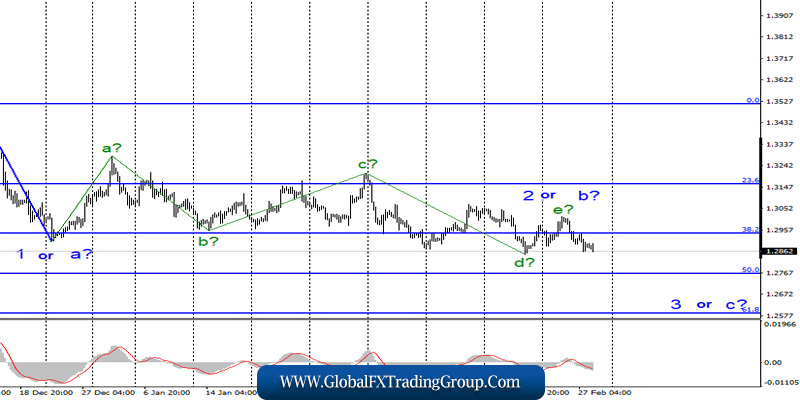

On February 27, GBP / USD pair lost about 15 basis points and supposedly completed the construction of wave e in 2 or b. If the current wave marking is correct, then the decline in quotes will continue within the framework of wave 3 or from a downward trend section. At the same time, a great complication of the current wave marking suggests that it is difficult for markets to decide on a trading strategy, and therefore, wave 3 or c may take on a more complicated form than is currently assumed.

Fundamental component:

The news background for the GBP / USD instrument on Thursday was similar. Demand for the US dollar remained stable throughout the day, and economic statistics supported the US currency. However, the reasons for the increase in the dollar may be not only data from the United States.

Boris Johnson and his government bring Britain closer to Brexit without agreement. It has recently become known that Britain is ready to leave negotiations with Michel Barnier’s group if it sees that there is no progress. In addition, Boris Johnson believes that Britain should get the agreement that he wants, like “Canadian” or “Australian”.

The European Union, on the other hand, is not ready to simply satisfy all the requests of the British prime minister and, in exchange, puts forward a number of conditions that Boris Johnson is not already satisfied with. Thus, the British can decline under the general oppression of the problems associated with the negotiations.

General conclusions and recommendations:

The pound / dollar instrument has complicated the current wave marking, which has now taken on a much more extended form. Thus, I recommend selling the instrument with targets located around the level of 1.2767, which corresponds to 50.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom