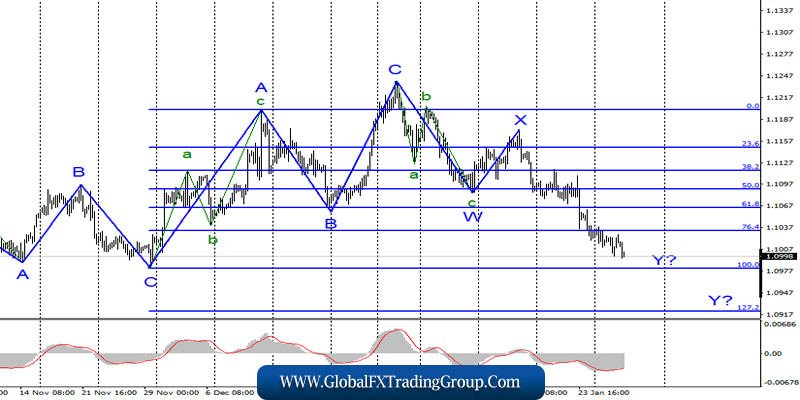

EUR/USD

On January 28, the EUR/USD pair gained several base points and thus continues to build the expected wave y. Markets continue to get rid of the European currency. An unsuccessful attempt to break through the Fibonacci level of 76.4% may lead to quotes moving away from the reached lows and completing the construction of a downward wave and the entire downward trend section. A successful attempt will indicate the readiness of the Forex market to continue selling the euro currency and complicate the wave y.

Fundamental component:

The news background on Tuesday was interesting. Markets were waiting for the release of the report on orders for durable goods in America. And the results of this report surprised me enough. The total number of orders increased in December by 2.0% compared to November 2019. Markets expected to see a much more modest value.

But other indicators were much worse than the expectations of the currency market. Orders for goods excluding defense decreased by 2.5%, excluding transport – decreased by 0.1%, and excluding defense orders and aviation – decreased by 0.9%. Thus, the data could be interpreted in different ways.

This is exactly what the markets did, which at first continued to sell the euro, and then slightly weakened their selling positions, which led to the departure of quotes from the reached lows. In general, the decline of the European currency continues. Today, all the market’s attention is focused on the evening meeting of the Fed, as well as on the speech of Jerome Powell. Economists, analysts, and currency market participants have little doubt that the US Central Bank will leave the key rate unchanged.

Thus, the main attention will be focused on the accompanying statement of the Fed, as well as on the speech of the Fed Chairman Jerome Powell and his rhetoric. The latest not-so-good reports from America make us consider an option in which the rhetoric of the head of the Fed will become more “dovish”.

Earlier, Powell said that during 2020, it is unlikely that the key rate will be revised downwards. However, if economic reports continue to deteriorate, the Fed may lower the rate again. In general, today, we just have to find out what has changed in the mood of the Fed.

General conclusions and recommendations:

The euro-dollar pair is presumably continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located around the mark of 1.0982, which corresponds to 100.0% of Fibonacci. An unsuccessful attempt to break this mark will lead to a departure of quotes from the reached lows and, possibly, the completion of the wave y. Otherwise, I recommend staying in sales.

GBP/USD

The GBP/USD pair lost about 40 basis points on January 28 and continues to decline within the expected wave 3 or C. The expected wave 3 or C, if it is currently being built, takes a very complex and extended form. The entire wave structure after December 23 may require adjustments and additions. Only a successful attempt to break through the Fibonacci level of 38.2% (the blue grid) can give confidence that the construction of the downward trend section will continue.

Fundamental component:

The news background for the GBP/USD instrument on Tuesday was the same as for the EUR/USD. And the market reaction was similar. There are no interesting news and economic reports from the UK at the moment, so only European and American news has to be examined.

Today – it’s the same meeting of the Fed, but tomorrow will be a meeting of the Bank of England and the markets are hoping to get information about the plans of the British Central Bank in the coming months, as rumors about the willingness to lower the key rate have been going for a long time. It may be lowered tomorrow.

In any case, the instrument needs to make a successful attempt to break the mark of 1.2941 to execute the main option. This requires strong comments today from Jerome Powell or weak comments tomorrow from Mark Carney (or a reduction in the key rate, or an increase in the number of votes cast for a rate cut).

General conclusions and recommendations:

The pound-dollar tool continues to build a new downward trend. I recommend selling the instrument with targets located around 1.2941 and 1.2764, which corresponds to 38.2% and 50.0% for Fibonacci. The tool can complicate the entire wave markup, so the increase can resume at 1.3329 (in the case of a successful attempt to break the 23.6% Fibonacci level) and then I recommend considering new sales of the tool around the mark of 1.3329.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom