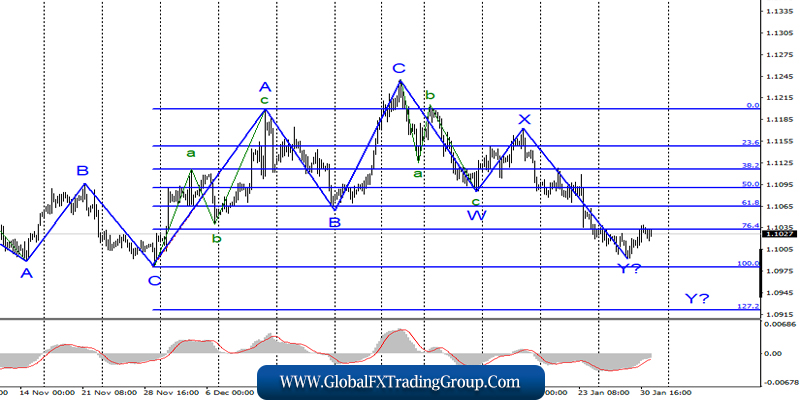

EUR/USD

On January 30, the EUR/USD pair added about 20 basis points and thus continues to move quotes away from the previously reached lows. The assumed wave Y is considered complete, and if this assumption is correct, the increase in quotes will continue as part of the construction of a new upward trend section. Most likely, the new upward section will also be three-wave, since in recent months the tool has been forming mainly corrective structures.

Fundamental component:

The news background on Thursday was very interesting. In general, the entire current week frankly pleases investors with the presence of interesting and important news and reports. However, this does not yet lead to an increase in the amplitude, which remains very modest. Yesterday, the most interesting news for the euro-dollar instrument came from America.

The GDP data fully matched market expectations and showed an increase of 2.1% in the fourth quarter. This value was recorded in the third quarter. The value of 2.1% may still be revised since it is not final. Also released is a fairly important index of personal consumption expenditures, which unexpectedly fell to 1.3% with the value of the third quarter of 2.1%.

Thus, the departure of quotes from the reached lows, that is, the decline of the dollar, was caused by weak economic reports from America. Also quite interesting was the consumer price index in Germany, which exceeded the value of last month and is equal to 1.7% y/y.

This report could add optimism to buyers of the euro, especially since the US reports were weak. However, today, on Friday, inflation in the European Union was only 1.4% y/y, and the core consumer price index fell to 1.1% y/y. Also, the eurozone’s GDP for the fourth quarter was disappointing, which declined from 1.2% in the third quarter to 1.0%.

Thus, this news may lead to the fact that the demand for the euro currency will fall again, and the dollar will grow again, which may cause not only the complication of the wave Y but also the entire downward trend section.

General conclusions and recommendations:

The euro-dollar pair have presumably completed the construction of a descending set of waves. The construction of the wave Y may resume, but based on the size of the waves W and X. The conclusion is still about the completion of this wave.

Thus, I recommend selling the instrument only if a successful attempt to break the mark of 1.0982 with the target of 1.0922, which corresponds to 127.2% for Fibonacci. I do not recommend buying the tool yet.

GBP/USD

The GBP/USD pair gained about 70 basis points on January 30. Thus, the section of the trend after December 31 continues to become more complicated, and at the moment, it is still unclear what kind of wave the instrument is currently in. It can be 2 or b or 3 or C. Either way, the markets can’t yet leave the range limited by the 23.6% and 38.2% Fibonacci levels (blue grid).

A successful attempt to break the mark of 1.3162 will show that the markets are ready to buy, and then the instrument will continue to form a very complex wave 2 or b. Unsuccessful – will lead to a new decline in quotes to the level of 38.2% for Fibonacci.

Fundamental component:

The news background for the GBP/USD instrument on Thursday was very important. Markets were waiting for the Bank of England’s interest rate decision. Moreover, there were real fears that the rate would be lowered, which would certainly cause serious pressure on the pound and a drop in demand for this currency.

However, the bank not only did not reduce the rate, but the voting among the members of the monetary committee showed a 0-2-7 alignment. That is, only two members voted to lower the rate. The markets were waiting for at least three to vote in favor, and possibly four. It is the fact that the majority of Central Bank governors refuse to apply such a measure as monetary easing that has caused additional demand for the pound.

Moreover, today is January 31, which means that the dream of Boris Johnson and most of the British people has come true. The UK is officially leaving the EU today and is beginning an 11-month process of adapting to new conditions outside the EU. There is certainly some euphoria about this among investors, but how long will it last?

General conclusions and recommendations:

The pound-dollar tool continues to build a new downward trend. However, the current wave markup is too complicated. Thus, I recommend selling the British only after a successful attempt to break the mark of 1.2940 with a target located around 1.2764, which is equal to 50.0% for Fibonacci, or wait for the completion of the construction of a complicated wave 2 or b and sell the instrument after that.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom