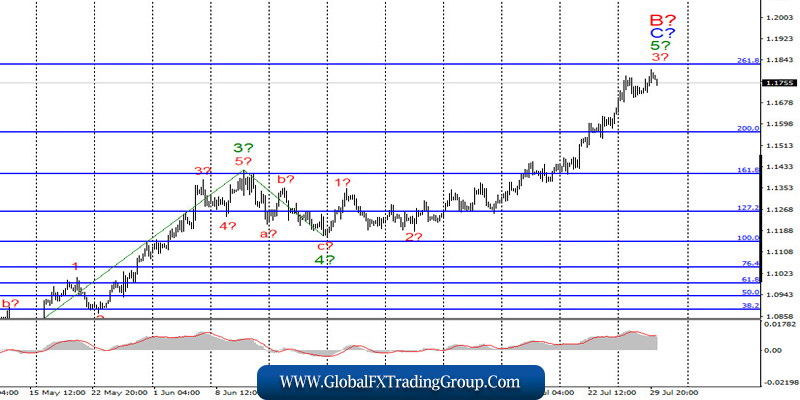

EUR / USD

On July 29, the EUR/USD pair gained about 70 pips and thus, continues to build an assumed wave 3 in 5 in C in B with targets located near the 261.8% Fibonacci level. An unsuccessful attempt to break through this level will indicate unavailability of traders to further purchase the instrument and can lead to completion of construction not only waves 3 in 5 to C to B, but of the entire wave C in B. In this case, the instrument will start building a new long-term downward trend section.

Fundamental component:

The key event of the past day was the Fed meeting and its results, while the coronavirus remains the key event for the whole of America and the markets. Yesterday, the Fed did not change its monetary policy and left rates unchanged, which is what the markets were expecting. However, Fed President, Jerome Powell noted at a press conference that it is the coronavirus that remains the main factor that will affect the economic recovery, its pace, and further actions to change monetary policy.

Powell expressed concern that the coronavirus will continue to have a very significant negative impact on the American economy. Thus, full economic recovery can be forgotten until the moment when the epidemic can be completely defeated. In addition, he also noted the high deflationary risks and promised that the Fed will do everything necessary to counter the crisis and epidemic. Several rather important reports have already been released in the European Union.

For example, the unemployment rate in Germany did not change compared to June and amounted to 6.4%, while the number of unemployed declined by 18 thousand. On the other hand, GDP for the second quarter turned out to be worse than the already poor forecasts and amounted to -11.7% y / y. The unemployment rate in the European Union rose to 7.8%. But the most interesting thing awaits us in the second half of the day, when the report on GDP for the second quarter in America is released.

Markets are expecting a huge drop in the US economy, down 34.5% from the first quarter. Thus, even if the real numbers are slightly better, it is unlikely to help the US currency. The demand for it may decline again in the afternoon, while the euro and the pound may continue to rise.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C in B. Thus, I recommend staying in the instrument purchases with the goals located near the calculated level of 1.1827, which equates to 261.8% by Fibonacci. Purchases can even be closed on the way to this level. I recommend opening further purchases of the instrument only in case of a successful attempt to break through the level of 1.1827.

GBP / USD

On July 29, the GBP/USD pair gained about 60 pips by the end of the day and thus, continues the construction of the expected wave 3 in 5. A successful attempt to break through the 100.0% Fibonacci level will indicate that the markets are ready for further growth in the British currency. In this case, the rise in quotes will continue within the same wave 3 to 5 with targets located near the 127.2% Fibonacci level. In any case, Wave 5 does not seem to be complete yet.

Fundamental component:

There was not a single important economic report in the UK this week. There was also little other news. Thus, the markets are still trading this instrument based on US statistics and news from this country. Today, the situation has not changed at all. The pound stood still waiting for the publication of the US GDP and is ready to start rising again if this report disappoints. There is almost a 100% probability that it will.

General conclusions and recommendations:

The pound/dollar pair continues to build upward wave 5, nothing changes. Therefore, at this time, I recommend waiting for a successful attempt to break through the level of 1.2990 and continue buying the instrument for each MACD signal “up” with targets located near the level of 1.3183, which equates to 127.2% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom