EUR / USD

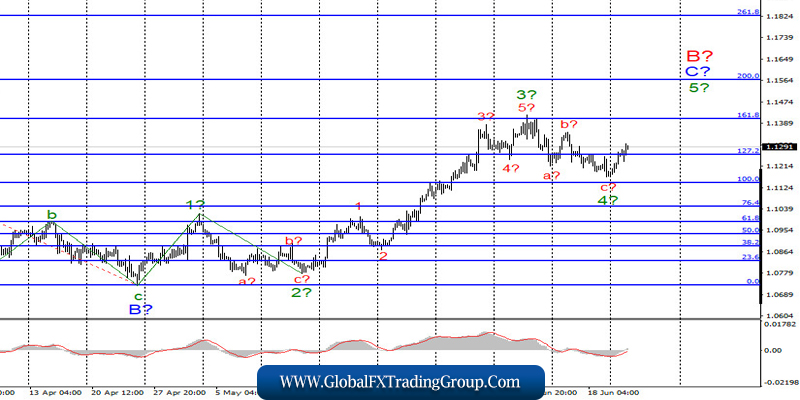

On June 22, the EUR/USD pair gained about 75 basis points and, thus, presumably completed the construction of the wave C in 4 in C in B. If this is true, then the instrument has moved on to building an upward wave 5. If the current wave markup is correct, then the increase in quotes will continue with the goals located above the 14 figure. At the same time, a decrease in quotes below the minimum of wave C in 4 will lead to the need to clarify the current wave markup.

Fundamental component:

On Monday, there were no interesting economic reports in America and the European Union, although there was plenty of other interesting information. For example, Donald Trump’s trading adviser, Peter Navarro, suddenly stated on Fox News that “the deal was closed.” Allegedly, U.S. President Donald Trump received irrefutable evidence of China’s guilt in developing the COVID-19 virus from intelligence and based on these data decided to terminate cooperation with Beijing. However, within a few hours, Trump himself wrote on his Twitter that the deal is ongoing and he hopes that China will continue to fulfill the terms of the agreement.

The markets are now very reasonably asking themselves the question: what happened in general? Why did Peter Navarro suddenly announce the termination of the deal with China? Later, the presidential adviser said that his words were taken out of context, however, questions from this did not reduce. Most market experts immediately stated that “there is no smoke without fire” and if everything was fine between the parties, then there would be no such statements. The problem is not only in America, which has enough claims against Beijing on the coronavirus, but also in China itself, which doubts the advisability of continuing to trade with America by agreement reached in January.

Everything is complete without politics. Before the election, Donald Trump needs to create the appearance of victory over China, and for this to happen, the deal must be respected. In general, according to most experts, the deal has included things literally too much over the past few months. Today, the European Union released three indexes of business activity – in the manufacturing sector, the services sector and the composite – and all three were better than market expectations, slightly increasing demand for the European currency.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for the MACD up signal, which allegedly announced the completion of wave 4 at C in B.

On June 22, the GBP/USD pair gained about 120 basis points. Thus, at the moment, wave 4 in 3 or C is considered complete. If this is true, then the increase in quotes of the instrument will continue with targets located at least about 29th figures. On the contrary, if the decline in quotes resumes and the low of wave 4 is updated, then all wave marking will require corrections and additions.

Fundamental component:

There was not much news in the UK on Monday, but the pound, like the euro, added a bit. The business activity indices in the manufacturing sector (50.1) and in the services sector (47) for June were already released today. Moreover, it should be noted that business activity in the manufacturing sector went above 50.0, so production in Britain began to increase. This is very good news for the pound, but today, this currency shows mixed dynamics and the demand for it has not increased.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave 3 or C. Thus, the purchases remain valid with targets located near the calculated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound on the last MACD signal “up” in the calculation of building a rising wave of 5 to 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom