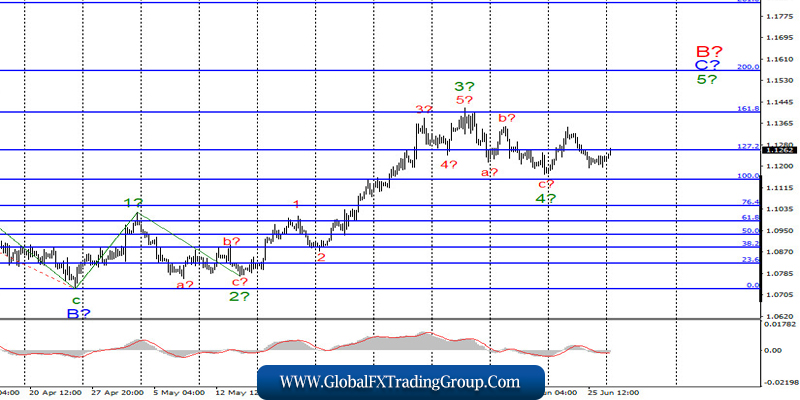

EUR / USD

On June 26, the EUR/USD pair has not won and has not lost a single basis point, and thus, the current wave markup has not changed at all and still assumes the construction of wave 5 in C in B. If this is true, then the increase in quotes will continue with the goals located near the 161.8% and 200.0% Fibonacci levels. On the other hand, wave 4 has become fully completed.

Fundamental component:

On Friday, the background for the euro/dollar instrument was rather weak. ECB President Christine Lagarde made a speech in Europe, but she did not say anything new, so the markets did not react to her words. Unfortunately, Christine Lagarde noted that the restoration of the European economy will be long and difficult. However, it will be no less long and difficult in the United States and other countries.

And in the United States, it is most likely the longest and most difficult because of the coronavirus, which continues to infect the population, with record cases of new infections every day, unlike in Europe, where the virus was able to be localized and stopped. Thanks to rallies, protests and, according to many doctors, the early removal of the “lockdown” infection continues to spread almost freely in the US, and in some states, local authorities decided to tighten quarantine again. For example, in Texas and Florida, public catering establishments were closed again, while in Miami, they can introduce a total “lockdown” with a ban on leaving home.

US Chief Infectionist, Anthony Fauci, said last Friday that “the situation with COVID-2019 is very serious.” Last Friday, 45,000 new cases of the disease were recorded, and anti-records are updated almost daily. Representatives of the health sector believe that real numbers can exceed the official 10 times.

Thus, the United States may return to the “lockdown” soon, although this may lead to a further decline in the US economy and an even greater drop in the political ratings of Donald Trump, all of whose actions in recent weeks are aimed at restoring the reputation and increasing popularity among voters.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Therefore, I recommend buying the pair with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each signal “up” MACD calculated on the construction of wave 5 in C in B.

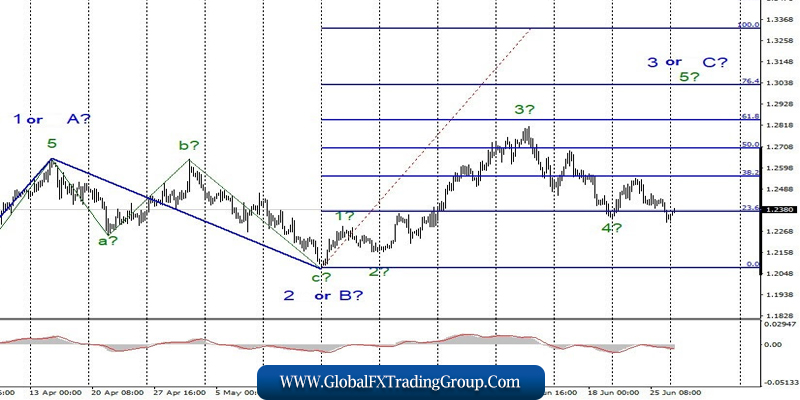

GBP / USD

On June 26, the GBP/USD pair lost another 95 basis points and cast doubt on the integrity of the current wave count. It is likely that the current wave marking will require adjustments and changes, and the entire upward trend section will either become very complicated (which is unlikely) or will be recognized as completed. For now, I recommend trading the instrument with extreme caution until the wave picture becomes clear.

Fundamental component:

Nothing interesting happened again in the UK on Friday, but the markets still found grounds for selling the pound, although the news background from the USA is now also very weak. Data on personal income and expenses of Americans in May showed a decline of 4.2% of the former and an increase of 8.2% of the latter.

Bank of England Chairman, Andrew Bailey, is scheduled to speak in Britain today, which could affect the mood of the market. Unfortunately, forecasts of leading analysts and analytical agencies also do not promise anything good for the pound. According to them, the UK economy will face a growing budget deficit next year. In addition, analysts believe that the British economy will recover very hard and for a long time, much longer than America or Europe.

General conclusions and recommendations:

The pound/dollar pair has greatly complicated the current wave marking, which is now no longer unambiguous and may suffer changes in the near future. Thus, I recommend not trading the pound/dollar pair until the wave picture is clear.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom