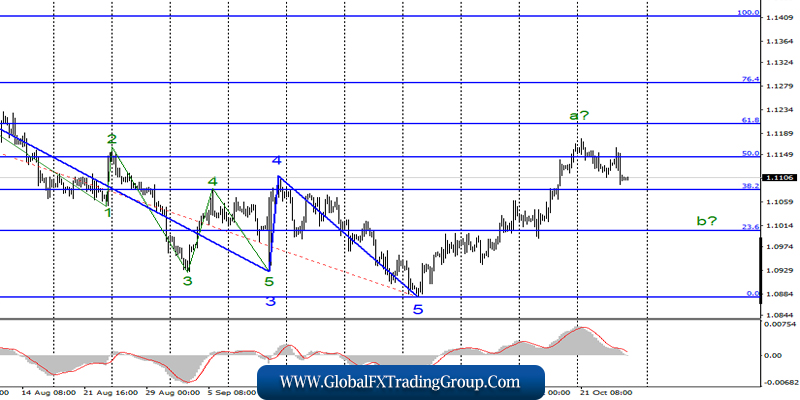

EUR / USD

Thursday, October 24, ended for the pair EUR / USD with a decline of 25 basis points. Thus, the construction of the proposed wave b as part of an ascending set of waves continues .

If this assumption is correct, then the quotation of the instrument will continue to decline, but an unsuccessful attempt to break through the 38.2% or 23.6% Fibonacci level will indicate the readiness of the markets to resume purchases and build an upward wave C.

As an alternative, bearish scenario can be discussed in case of a successful attempt to break through the level of 23.6%.

Fundamental component:

The news background for the EUR / USD pair was very strong over the past day. We have indices of business activity in Germany, the European Union, and America, orders for durable goods in the USA, a speech by Mario Draghi and summing up, the meeting of the European Central Bank.

It is somehow strange that the pair limited itself to a downward movement of only 25 points. However, there was still a jump up during the day, so the activity of the currency market was at the level. On the other hand, business activity in Germany and the EU are disappointing again.

The manufacturing sector causes the greatest concern, since business activity in it is at extremely low values. Nevertheless, the situation in America is a little better: all three indexes according to Markit version exceeded the values for September and remain to balance above the level of 50, while maintaining, albeit minimal, growth.

The European Central Bank decided not to change key rates in October, and Mario Draghi, whom we last saw as a presenter, didn’t tell the markets anything supernatural or new. The most interesting was the report on orders for durable goods for September in the United States. It turned out that all categories suffered reductions.

The overall indicator declined by 1.1%, and the most relevant, excluding defense and aviation orders, lost 0.5%.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward wave set and has completed the construction of wave a. The breakdown of the level of 50.0% in the opposite direction indicated the readiness of the instrument to build wave b, which has already taken a three-wave form.

I recommend buying an instrument after the completion of building wave b with targets located about 12 figures and above.

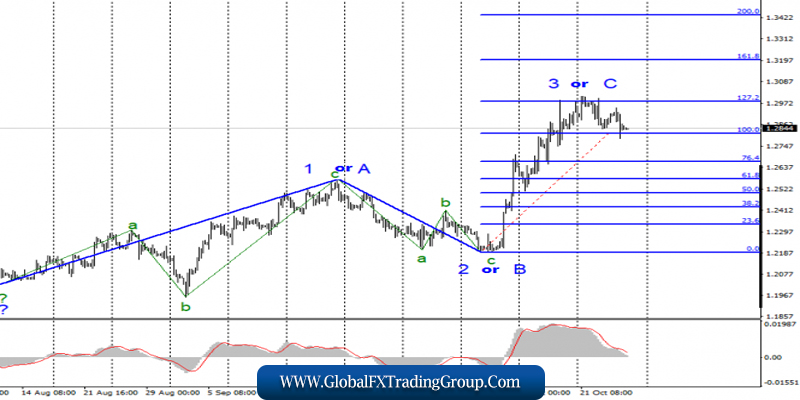

GBP / USD

On October 24, the GBP / USD pair lost about 60 basis points, despite the fact that the economic reports only from the United States, which were generally weak, concerned this instrument.

However, the wave marking of the instrument implies just a decline, since wave 3 or C is completed. Therefore, either wave 4 or the first as part of a new downward trend section has begun to build. One way or another, but a decline.

Wave 3 or C may turn out to be more extended, however, the news background cannot now be regarded in favor of the pound.

Fundamental component:

Parliamentary elections. This is the strategy that Boris Johnson will now adhere to in negotiations with members of Parliament. After Parliament passed the bill on a deal with the European Union, but rejected Johnson’s offer to consider it in three days, it became clear to absolutely everything that nothing would happen before October 31 and there would be no Brexit.

Yesterday, the European Union reaffirmed its readiness to give a reprieve to London. Thus, Johnson will now try to hold early elections by all means, since it is in them that he sees the opportunity to lead the country out of the impasse in which it finds itself.

However, will Parliament itself agree to an early election? Given Johnson’s fixed idea of pulling Britain out of the EU in any scenario, the parliament may be cautious in this matter. Be that as it may, we will witness the next series of the series called “Brexit”, which will now be delayed until at least January 31, 2020.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. An unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline.

Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom