In the most global sense, the wave counting of the EUR / USD instrument has not changed in recent days or even weeks and looks quite convincing. Supposed wave 3 or C has completed its formation. Thus, if this is wave 3, then wave 4 of the upward trend should now be built, after which the rise in the euro currency quotes will resume as part of the construction of wave 5. If this is wave C, then the decline will continue within a new downward trend segment, which is not yet clear what shape and form it will take. But in any case, the instrument should build a downward wave.

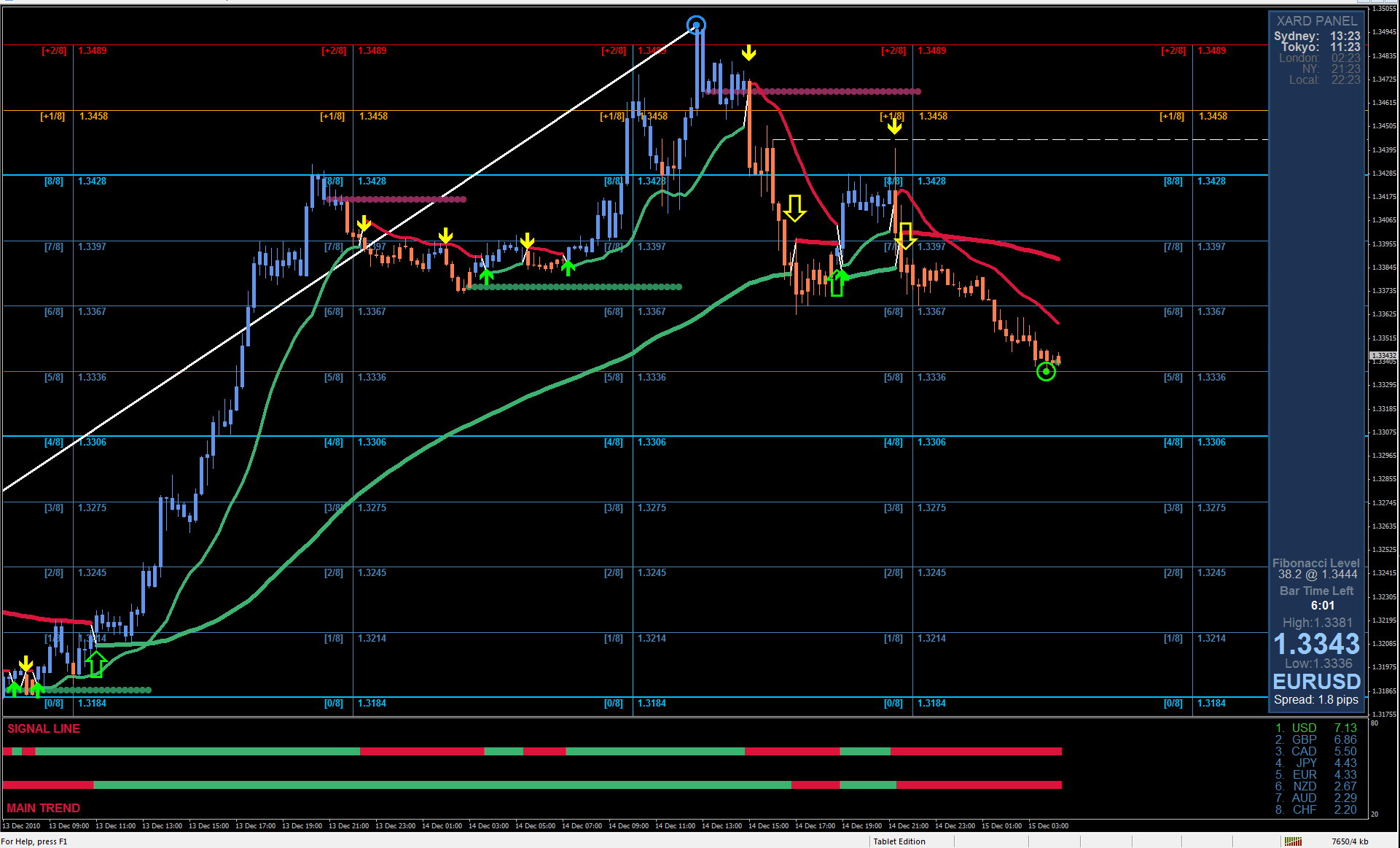

The wave counting on a smaller scale also shows that the supposed wave 3 or C is complete. But until a successful breakout of the low of wave 4 at 5 at 3 or C, no definite conclusion can be drawn. If at the moment the construction of wave 4 is in progress, then it should take a three-wave form. If what we see now is wave 4, then it takes on an extremely short form. Thus, I do not recommend selling the instrument now, based on the current wave counting. At the same time, it is not yet clear whether the construction of the upward trend will continue since there are no preconditions for the start of wave 5 construction at the moment.

On Wednesday, August 26, the report on the rate of orders for durable goods in America captured my interest. The indicator rose by 11.2% in July, which is greater than the market expectations of 4.3%. However, the demand for the US dollar still fell sharply in the afternoon, but today before Jerome Powell’s speech in Jackson Hole it went up. At the same time, the amplitude of the movement of the Euro / Dollar instrument remains minimal with only a few dozen points.

For example, yesterday ended with a decline of only 6 points. A day earlier, the instrument gained 48 points. Powell’s speech today may provide answers to many questions of interest to the markets, or it may turn out to be absolutely superficial, not touching upon important questions of monetary policy.

The current state of the US economy forces us to ask questions about unemployment, about the recovery, the support of the unemployed and small and medium-sized businesses by the state, as well as linking inflation (which may start to grow in the near future) to the interest rate. The last question is generally extremely important.

According to many economists, in the near future, inflation may return to 2% and even exceed this level. However, the Fed previously tied inflation to a key rate hike. That is, if inflation for several months in a row exceeded 2%, then the rate was raised, and the monetary policy was tightened. Now, this cannot be done, since there is still at least a couple of years before the full economic recovery. Powell will have to answer all these questions.

General conclusions and recommendations:

The Euro-Dollar pair resumed building the assumed global wave 3 or C. Thus, at this time, I recommend new purchases of the instrument with targets located near the calculated level of 1.2089, which corresponds to 323.6% Fibonacci, for each upward signal of the MACD. At the same time, wave 5 in 5 in 3 or C could have already ended. If the low of wave 4 is passed, then after the construction of corrective wave 2 or b, it will be possible to open sales for the instrument. But only if the three-wave structure of wave 4 is clear and sure.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom