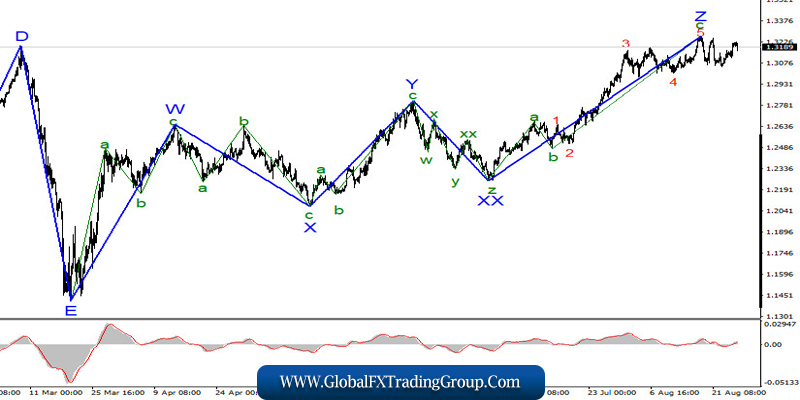

The wave structure of the upward trend took a quite finished appearance several times, however, the high demand for British and low for the dollar led to the fact that the upward trend again has become more complicated and took an even longer look. The wave Z can become more complex under current conditions almost indefinitely.

The lower graph will show that there can be any number of smaller wave structures inside the wave Z. Thus, now is the case when the wave pattern will adjust to the demand for the US dollar. If the demand does not grow in the near future, the increase in the quotes of the instrument will continue.

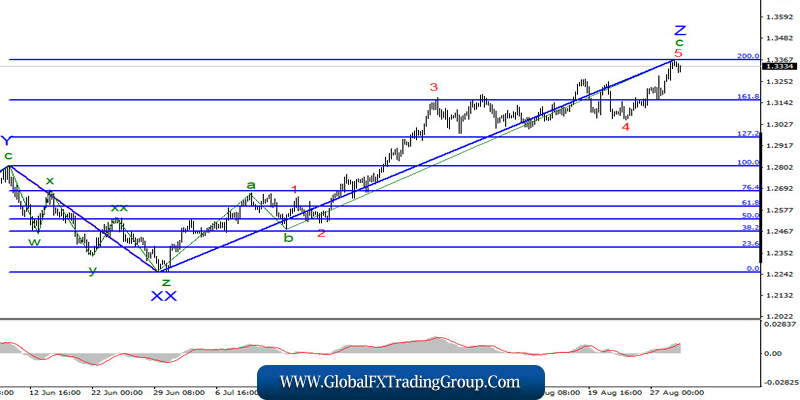

However, a closer examination of the current wave pattern shows that the upward trend has become more complicated. The wave pattern has once again assumed a complete form, however, the wave C-Z can become more complicated once and several times more. It’s just that the internal wave structure of wave C-Z will become more complex each time. Thus, at the moment, I can’t make a conclusion about when the construction of the upward trend section will be completed. Everything will depend on the news background and market demand for the US currency.

The most important thing for the pound/dollar instrument was also the performance of Jerome Powell at Jackson Hole, after which the Briton soared up. However, on Friday, there was also a speech by the Governor of the Bank of England, Andrew Bailey, who did not make any high-profile statements about monetary policy. Nevertheless, Bailey still said that the Bank of England still has a fairly large number of tools to influence monetary policy, despite the extreme rate cut to 0.1% and the expansion of the QE program.

That is, the British Central Bank can further increase the program of asset repurchase from the open market and lower the rate even more in order to support the British economy. In addition, America released an updated and inconclusive report on GDP in the second quarter, according to which losses were no longer 32.9%, but 31.7%. This is even good news for the US currency, although the failure of the US economy is still gigantic.

Apparently, the markets decided that one and a half percent of the difference is insignificant, and did not increase the demand for the dollar. Thus, the current wave markup has become more complex. On Monday, August 31, there were no scheduled events or economic reports in the UK, the US and the European Union. Thus, the trading was held in a fairly calm mode.

General conclusions and recommendations:

The pound/dollar instrument resumed building the upward wave Z and could immediately complete it. Thus, I would not recommend making new purchases of the instrument now. At the same time, sales of the instrument also do not look very attractive, since there is no confirmation of the end of the upward trend section, and the low of the previous wave 4 was not passed.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom