Yesterday, the price repeated Tuesday’s scenario – the daily candle tested the boundaries of the range between 1.0825 and 1.0905 with candles, and the day closed with a long black body.

However, the price closed the day below the MACD indicator line, and today, it opened below this line. The European Central Bank meeting and ECB President Christine Lagarde’s subsequent speech were neutral.

There are currently more technical prerequisites for breaking through support, but overall, market interest in risk has increased significantly – almost all financial market instruments rose yesterday, from stock markets to bonds and gold. This increase in risk appetite was driven by strong US GDP data – 3.3% growth in the fourth quarter, exceeding the forecast of 2.0%.

Investors may be expecting a dovish tone from the Federal Reserve at its January 31 meeting. Now, any of the euro’s movements could turn out to be a false move. We are waiting for the key event of the upcoming week. We believe that the Federal Reserve will be the first to start the rate-cut cycle, so the Fed may also start to show verbal signals.

Today, the US will release data on income and spending for December, with positive forecasts, and this could fuel the rise of riskier assets, including the euro.

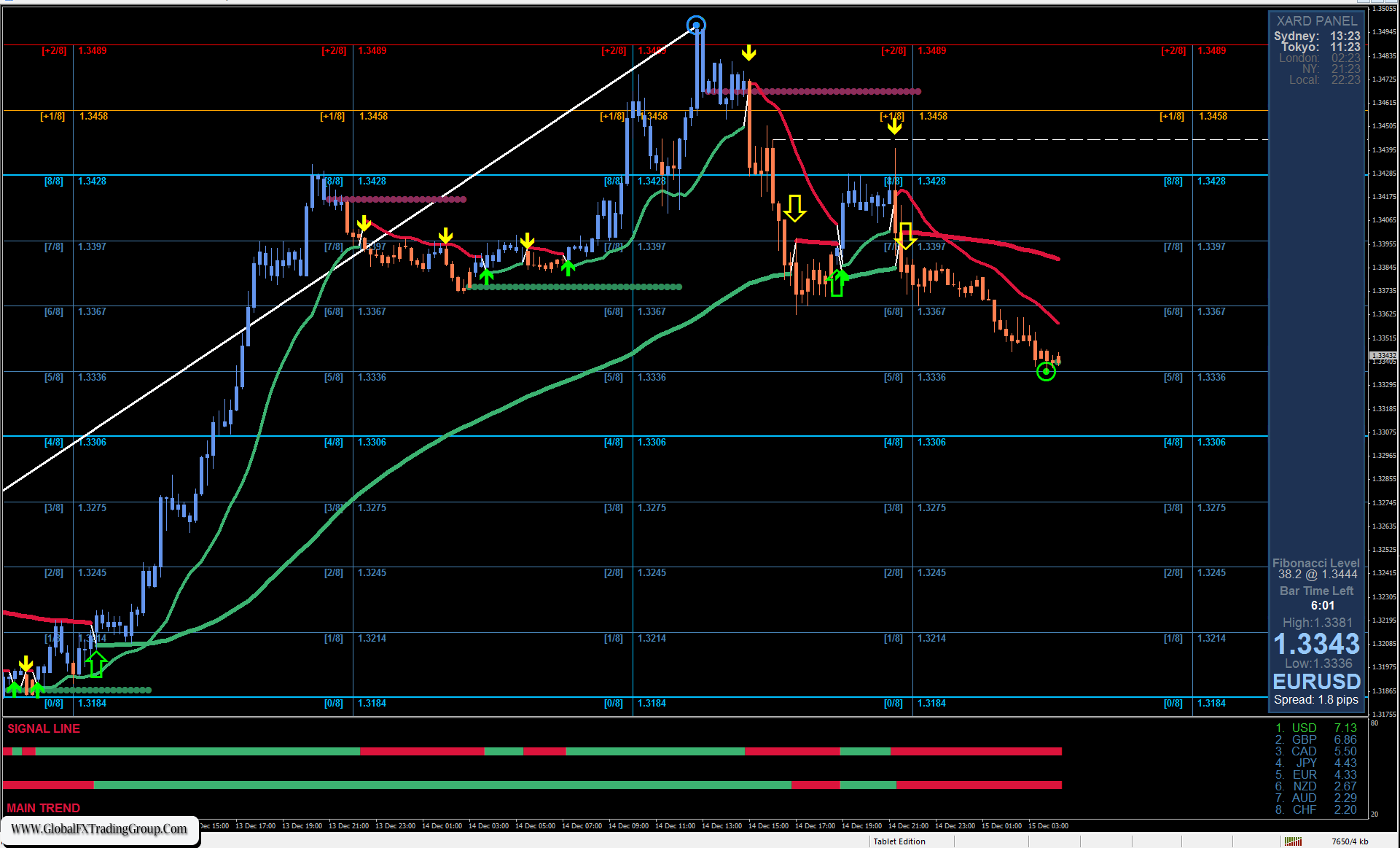

On the 4-hour chart, the price and oscillator have formed a semblance of a double or even triple convergence. We can confirm this once the price settles above the MACD line (1.0855). Take note that the MACD line coincides in price level with the daily MACD line (1.0857), and overcoming such significant resistance could push the euro upward.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom