Yesterday, the euro made its third attempt to overcome the lower limit of the 1.0962-1.1121 range. This attempt was already noticeably weaker than on Wednesday, although trading volumes were even higher.

This looks like a repositioning of players and the likelihood of at least a short-term rise in the euro, even despite the sharply increased hawkish sentiment among FOMC members warning of a double rate hike at the May meeting and weak business sentiment forecasts in Germany published today. Thus, the business climate index for March is expected to decline from 98.9 to 94.2.

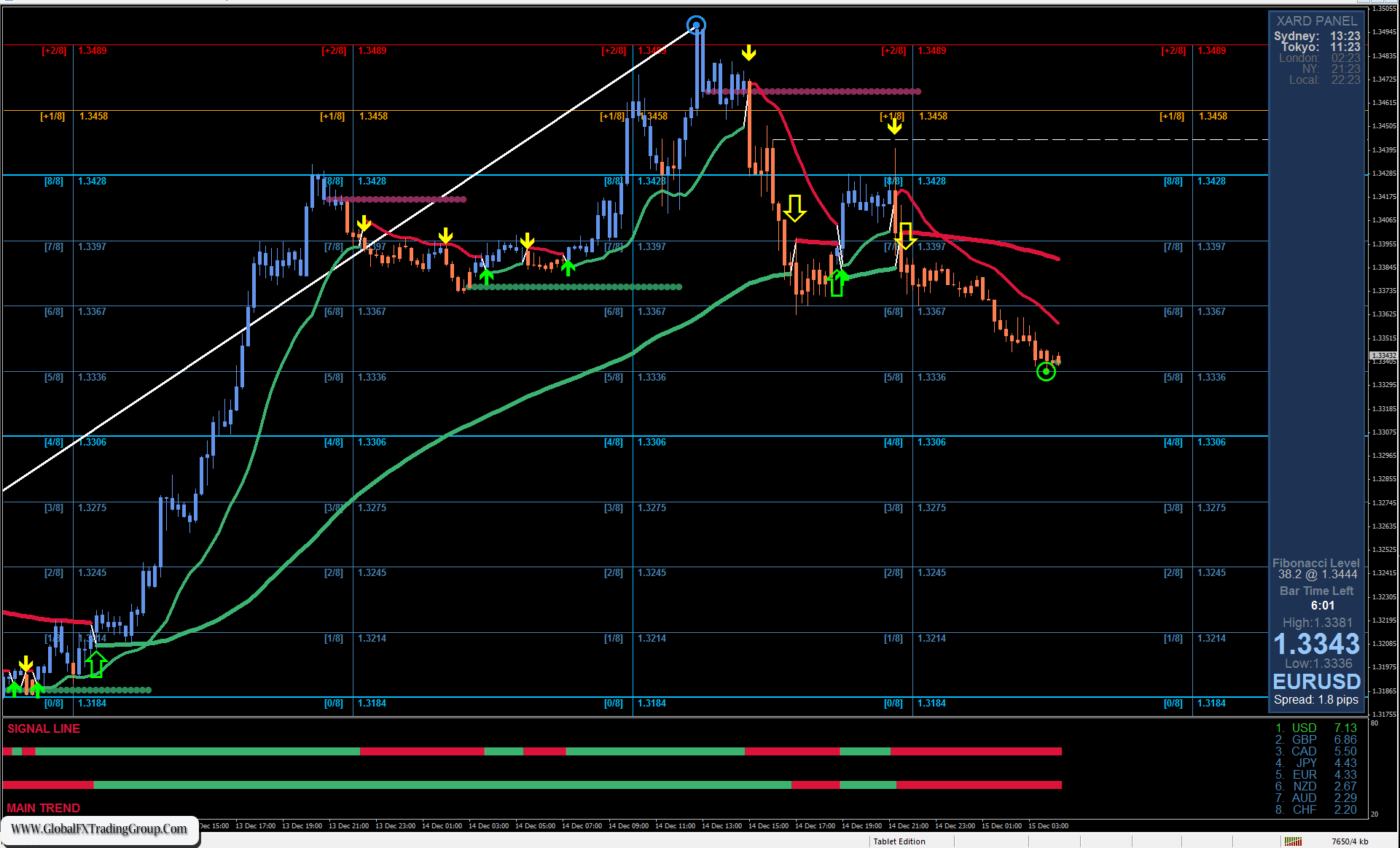

The Marlin Oscillator is still in negative territory on the daily chart, but it already shows the intention to break out of it in the near future. But for a steady growth, it must consolidate above the MACD indicator line, above 1.1166, where the Fibonacci channel line, marked in green, also passes. Until this happens, there might be chaotic price movements in the 1.0962-1.1121 range, by analogy with the period of October-December 2019, only then the consolidation was placed a little higher.

On the four-hour chart, the price turned up from the MACD line yesterday. The price goes above the balance indicator line, which indicates a shift in players’ interest in buying. The Marlin Oscillator has penetrated into the zone of a growing trend this morning. These are all signs of a short-term upward trend. Its demolition, the price reversal into a medium-term decline, will occur if the price settles under the signal level of 1.0962. The 1.1121 target is formally open, but the very fact of the price development in the sideways forces to be cautious about this growth.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom