Yesterday the markets received unexpected news. During the negotiations between Russia and Ukraine in Turkey, a cardinal shift was announced in resolving the main issues: guarantees of Ukraine’s security, agreement to discuss the status of Crimea, the functioning of humanitarian corridors on an ongoing basis, and other issues.

At the same time, Russian Deputy Defense Minister Alexander Fomin announced a sharp decrease in military activity in the Kiev and Chernigov directions in order to create a further favorable negotiation process. The dollar index fell 0.72%.

On the daily chart, the euro with its upper shadow almost reached the MACD line, approaching the embedded price channel line of the higher timeframe as well. It is very likely that the euro will try to close the price gap on February 25 and 28, that is, the upper limit of the price channel will be worked out, and the target level will be 1.1315 – the Fibonacci reaction level of 161.8%. But the price still has a strong resistance in the area of 1.1155 on this path – this is the MACD indicator line itself and the green line of the price descending channel of the monthly timeframe. It should be noted here that we do not share the optimism of the euro bulls in the growth above 1.1315.

The main burden for the single currency will be the reduction in Russia’s natural gas supplies. Germany’s refusal to pay for gas in rubles has already led to the closure of the Yamal-Europe pipeline (the rest of the pipelines are operating normally). The IEA-developed plan for the EU to phase out Russian gas still provides for a gas deficit for Europe of 20% of 2021 consumption. Undoubtedly, regardless of whether Europe agrees to pay for gas in rubles (of course, after the Ukrainian military crisis is over) or still not, for Europe, alternative supplies will increase in price, and this will put strong pressure on the economy and on the euro. The European Central Bank, apparently, will not dare to tighten monetary policy.

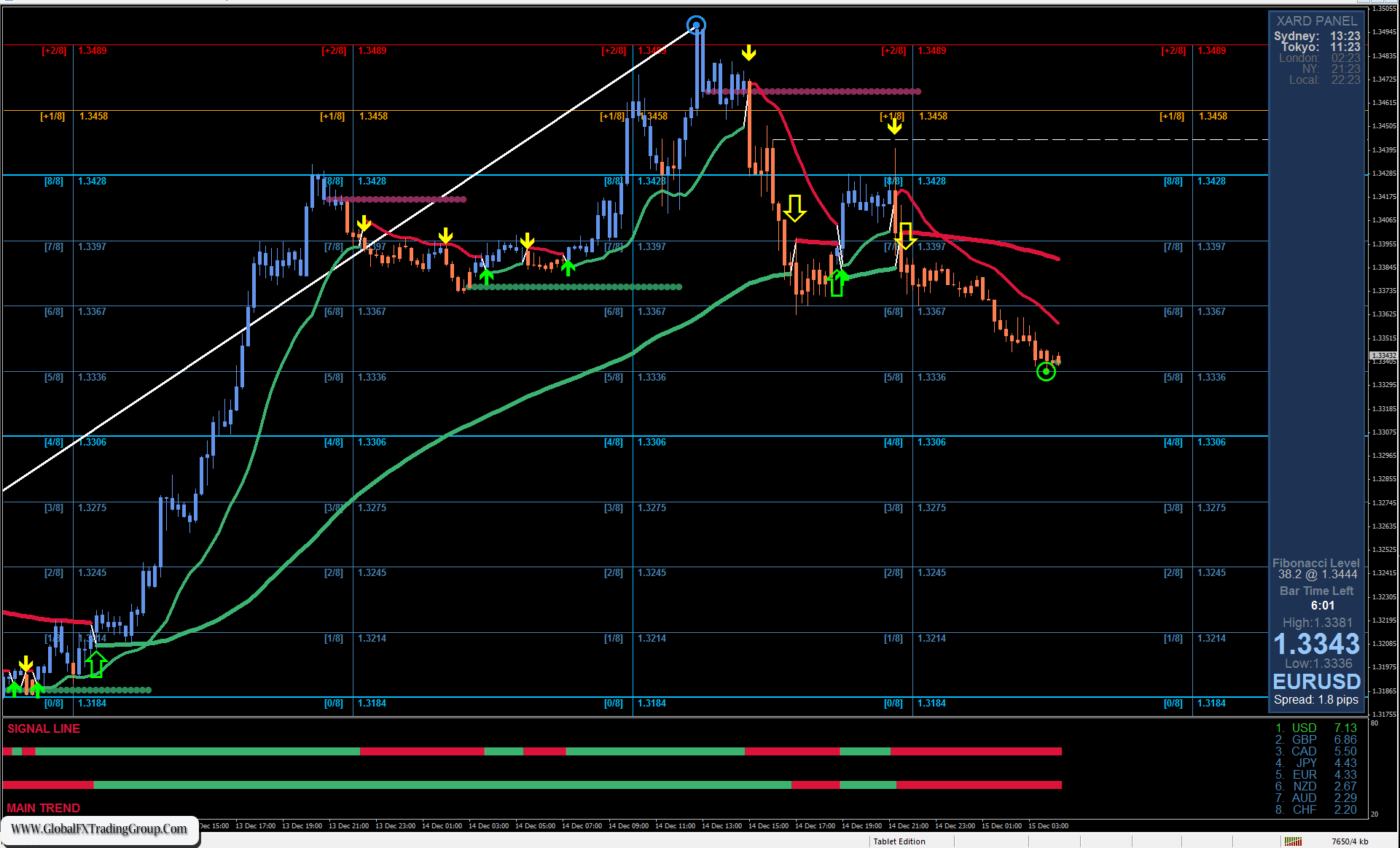

The price is completely in an upward position on the four-hour chart: the growth continues above the indicator lines, the Marlin Oscillator is in the zone of a growing trend. The price is getting ready to attack the resistance 1.1155 with an attempt to consolidate above the level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom