Yesterday, the euro made another attempt to rise. The daily balance indicator line stopped the price from rising. The pair was up 7 pips. The euro failed to trade higher against the backdrop of a strong rise in the stock market – the S&P 500 added 1.03%. There was no significant movement in the bond market either.

The stock market’s rise was partly due to Hamas’ statement about a ceasefire, and partly because investors continued to play out the prospect of the Federal Reserve maintaining its rate for a longer period.

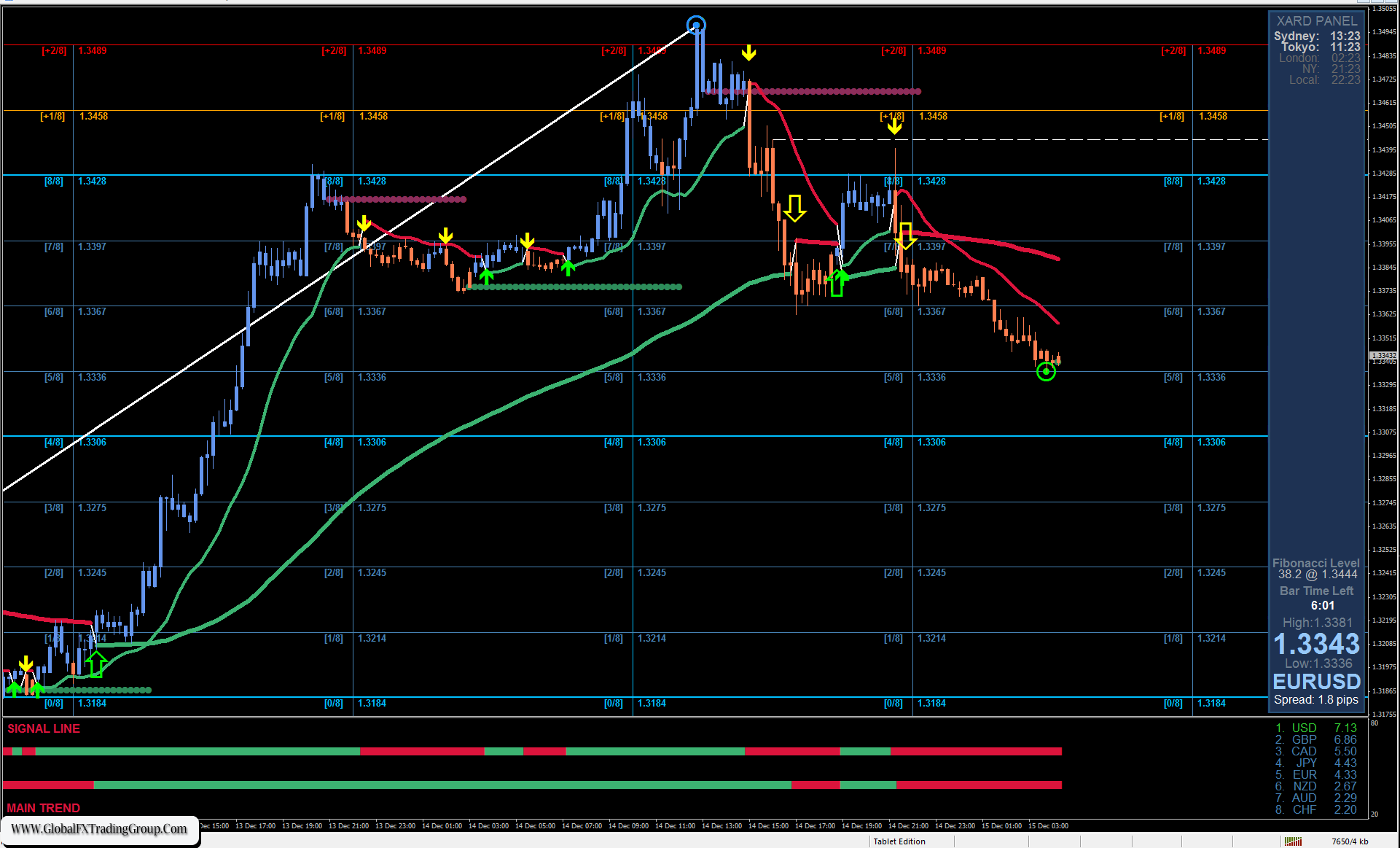

A strong pessimistic reason is needed to change the market’s mood. But the euro also needs an optimistic reason to rise. For now, the single currency is trying to settle in the neutral range of 1.0757/96, or even in the extended range of 1.0724/96. More precisely, the upper boundary of the range is represented by the MACD indicator line at the level of 1.0807.

Over time, this boundary decreases and will coincide with the level of 1.0796. If the price consolidates above 1.0796, it will open the target level of 1.0905. But in order to do so, the stock market must surge so that the euro can prepare before the European Central Bank rate cut on June 6.

On the 4-hour chart, the euro is moving sideways above both indicator lines with a declining Marlin oscillator. Time is currently on the euro’s side – encouraging market participants to open long positions during consolidation. However, this may be a trap for the bulls. Our main scenario is bearish.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom