Analysis of transactions in the EUR / USD pair

Several signals appeared in the market last Friday. The first one is to buy at 1.2095, which had to be ignored because the MACD line, during that time, was in the overbought zone. Then, the next signal is to again buy at 1.2095, but this time, the MACD line was around zero, so EUR / USD was able to move up by more than 35 pips. The euro even reached the target value, which is 1.2130.

Trading recommendations for February 22

Euro traded upwards last Friday amid quite good reports from the EU. Today, this bullish movement could continue if data from Germany also turn out better than expected.

For long positions:

Buy the euro when the quote reaches 1.2140 (green line on the chart), and then take profit around the level of 1.2186. EUR / USD will rally if there are very good economic reports from the EU.

Keep in mind that before buying, the MACD line should be above zero and is starting to rise from it.

For short positions:

Sell the euro after the quote reaches 1.2108 (red line on the chart), and then take profit at the level of 1.2062. Pressure on the euro may return if data from Germany are weaker than the forecasts.

But of course, before selling, it is important to make sure that the MACD line is below zero and is starting to move down from it.

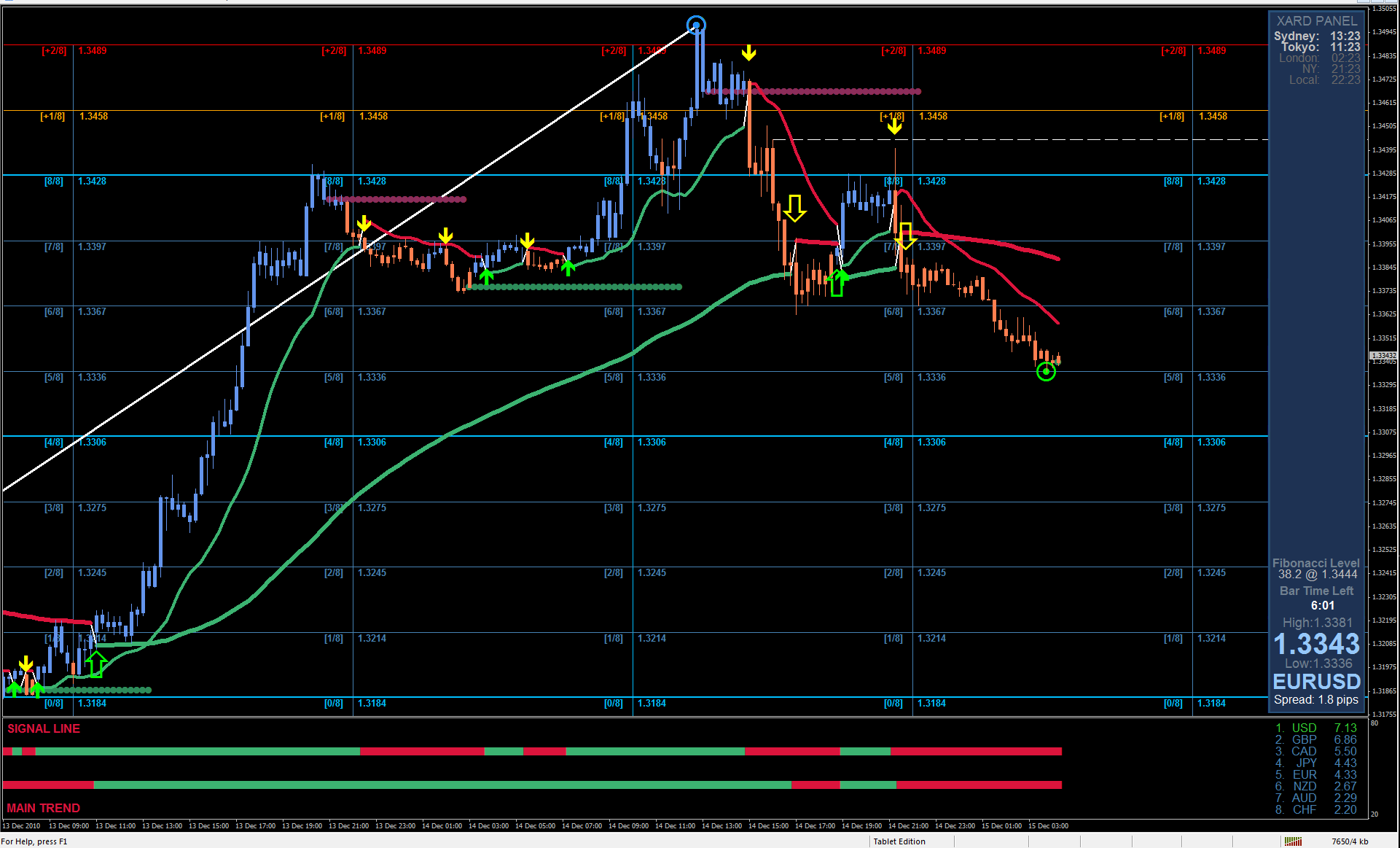

What’s on the chart:

- The thin green line is the key level at which you can place long positions in the EUR / USD pair.

- The thick green line is the target price, since the quote is unlikely to move above this level.

- The thin red line is the level at which you can place short positions in the EUR / USD pair.

- The thick red line is the target price, since the quote is unlikely to move below this level.

- MACD line – when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

Analysis of transactions in the GBP / USD pair

Good data from the UK led to a strong buy signal at 1.3966. And since the MACD line, during this time, was in a positive zone, GBP / USD was able to move up by around 50 pips.

Trading recommendations for February 22

Volatility is expected to be low today, so GBP / USD may trade sideways. But a good report for the UK economy could lead to a break above 1.4033.

For long positions:

Buy the pound when the quote reaches 1.4033 (green line on the chart), and then take profit at the level of 1.4091 (thicker green line on the chart). GBP / USD will continue to trade upwards if there are very good economic reports from the UK.

Keep in mind that before buying, make sure that the MACD line is above zero and is starting to rise from it.

For short positions:

Sell the pound after the quote reaches 1.3997 (red line on the chart), and then take profit at the level of 1.3948. It is not a good idea to trade against the trend, but a break below 1.3997 may lead to a good downward correction.

Keep in mind that before selling, make sure that the MACD line is below zero and is starting to move down from it.

What’s on the chart:

- The thin green line is the key level at which you can place long positions in the GBP / USD pair.

- The thick green line is the target price, since the quote is unlikely to move above this level.

- The thin red line is the level at which you can place short positions in the GBP / USD pair.

- The thick red line is the target price, since the quote is unlikely to move below this level.

- MACD line – when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom