Analysis of transactions in the EUR / USD pair

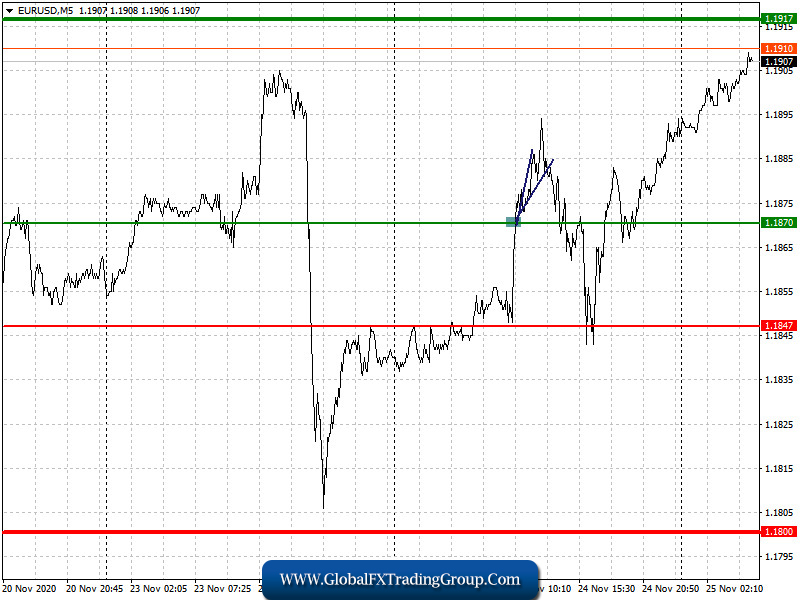

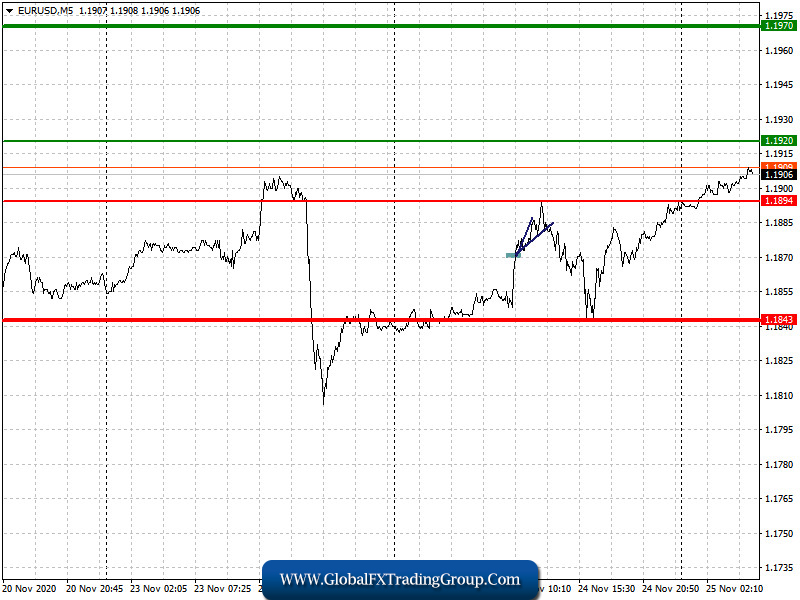

The continued growth of the German economy in the 3rd quarter preserved the hope for the euro, which led to the formation of a very strong buy signal from the level of 1.1870. However, the upward movement only to 15 pips, mainly because the bears tried to regain control of the market. Fortunately, the weak report on US consumer confidence quickly thwarted the decline, thus, the EUR / USD pair returned to weekly highs today during the Asian session.

Trading recommendations for November 25

Quite a number of economic reports are scheduled to come out from the United States today. For example, the latest figure of jobless claims and the growth rate of the US GDP for the 3rd quarter. If the number of jobless claims continues to decline in November this year, the position of the dollar will strengthen, which is a very strong signal to buy the currency. Growth in incomes and expenses of the Americans may also return the demand for the dollar, which will lead to a downward correction of the EUR / USD pair.

But if the data coincides with the forecasts, the focus of traders will be shifted to the statements from the Federal Reserve, which, although unlikely to have a serious impact on the market, since the committee is not going to change its monetary policy in the near future, will maintain the bullish momentum in the EUR / USD pair.

Open a long position when the euro reaches a quote of 1.1920 (green line on the chart) and then take profit at the level of 1.1970. However, growth will occur only in the event of good data on the eurozone economy. Open a short position when the euro reaches a quote of 1.1894 (red line on the chart) and then take profit around the level of 1.1843. However, do this only if the data on US GDP turns out to be much better than the forecasts, and if the statements by the Federal Reserve contain hints that monetary policy will remain unchanged for a long time.

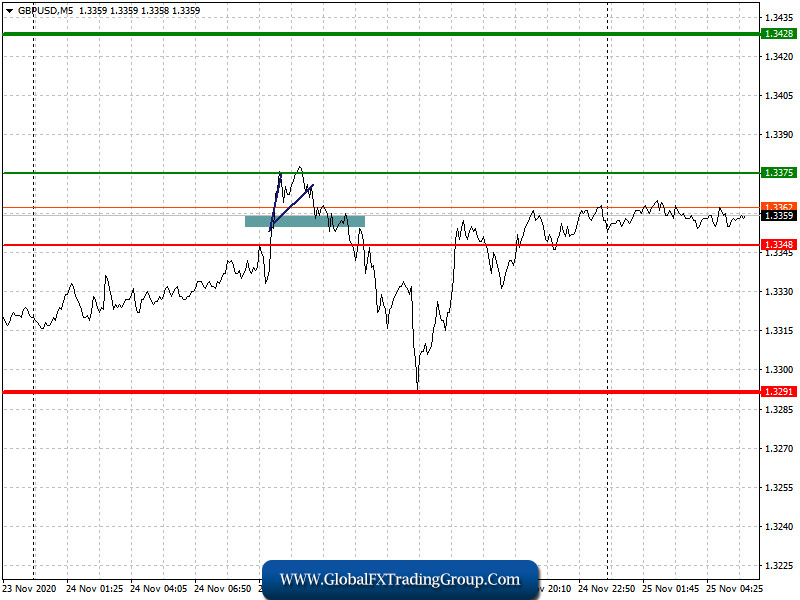

Analysis of transactions in the GBP / USD pair

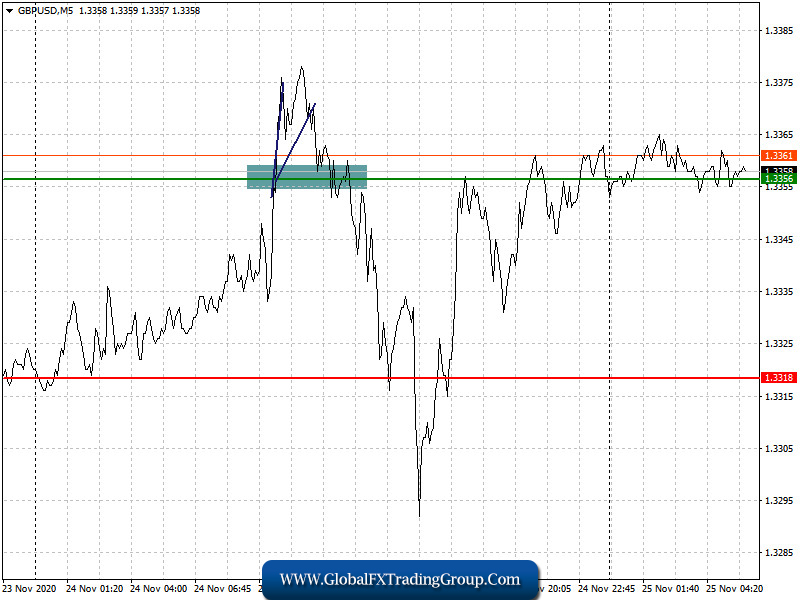

Uncertainty over Brexit continues to concern many traders since at any moment, news may appear, which will determine the future of the British pound. In the meantime, long positions from 1.3358 were unsuccessful as growth in the currency only, to 20 pips. Nonetheless, there are hopes for recovery, so many await for news on the Brexit negotiations.

Trading recommendations for November 25

The pound will move today depending on the latest reports on the US economy. If its data indicate strong growth rates, for example, in income and consumer spending, demand for the US dollar will increase. The same will happen if the data on durable goods come out much better than expected.

Open a long position when the quote reaches the level of 1.3375 (green line on the chart) and then take profit around the level of 1.3428 (thicker green line on the chart). Good news on Brexit may strengthen the British pound. Open a short position when the quote reaches the level of 1.3348 (red line on the chart) and then take profit around the level of 1.3291. Bad news on Brexit, as well as good data on the US economy, will resume the downward trend in the GBP / USD pair.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom