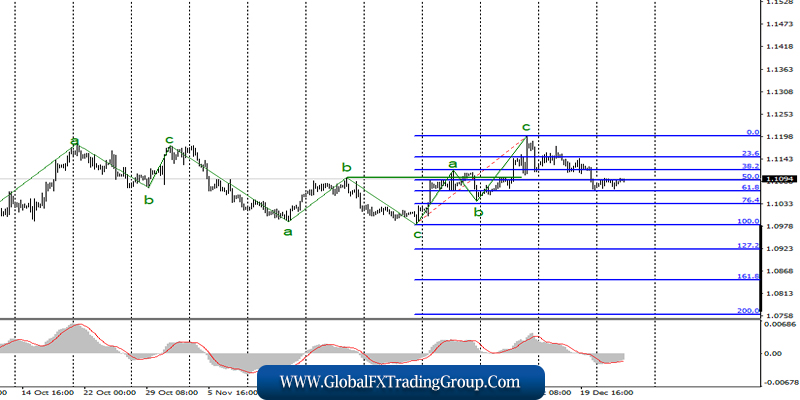

EUR/USD

On December 25, the EUR/USD currency market was closed, so there was no trading. The current wave marking, thus, remains the same.

The euro-dollar instrument continues to be held between the levels of 50.0% and 61.8% by Fibonacci, and although it retains excellent chances of continuing the fall within the new downward trend section, however, during the New Year and Christmas holidays, the execution of the working version can be put on pause.

Given the weakest market activity, perhaps the best option is to wait until all the holidays are over.

Fundamental component:

Markets only opened early this morning. The news background for the tool remains missing. No economic reports, no speeches by heads of state or central banks, no interesting data or reports from Parliaments or Congress (USA). Only Donald Trump, President of the United States, continues to do posts on social networks from time to time, continuing verbal skirmishes with representatives of the Democratic Party, who, by the way, do not respond to the president’s insults.

The case, of course, concerns impeachment, which soon can be transferred to the Senate, which will decide the fate of the president. However, all those political news can be of little help to the foreign exchange market. Information about the impeachment and the fact of the investigation is, of course, interesting, but the euro-dollar tool (and other tools, too) is not affected.

Today in America, one economic report will be released – on applications for unemployment benefits for the week of December 13-20, but this indicator usually does not cause any market reaction. Most likely, it will be so today. Thus, I recommend waiting for news, waiting for economic reports, waiting for the holidays to end, because now is not the best time to try to make money in a market that is almost immobilized.

General conclusions and recommendations:

The euro-dollar pair have presumably completed the construction of an upward trend section. Thus, I would recommend selling the instrument with targets located near the marks of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% for Fibonacci.

An unsuccessful attempt to break through the level of 50.0% may lead to the completion of the withdrawal of quotes from the reached lows and the resumption of building a downward wave. At the same time, given the festive mood of the market, the decline may resume after the New Year.

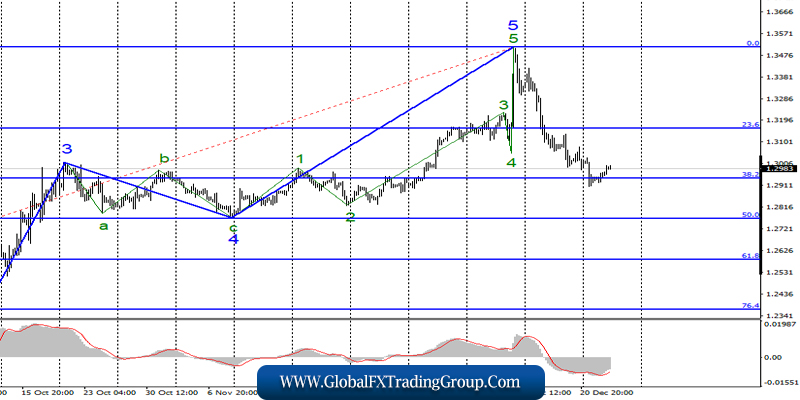

GBP/USD

On December 24, the GBP/USD pair increased by 20 basis points, and on the morning of December 26, added another 30 points and, presumably, completed the construction of the first downward wave as part of a new downward trend section.

If this assumption is correct, then the price increase will continue to the area of 23.6% Fibonacci level in the framework of building a wave 2 or b. I recommend that you consider the corrective wave as an opportunity to sell the instrument at a more attractive rate.

Fundamental component:

There is no news background for the GBP/USD instrument. The UK Parliament and the Prime Minister have already gone on New Year’s holidays, so no information on political topics is currently available. The same is true of economic reports.

For this week, the economic news calendar is empty. Thus, the activity may decrease for the GBP/USD instrument, and the markets can only wait for the holidays to end.

General conclusions and recommendations:

The pound-dollar instrument continues to build a new downward trend. I recommend resuming sales of the instrument with targets located near the mark of 1.2764, which corresponds to the 50.0% Fibonacci level, after the completion of wave 2 or b.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom