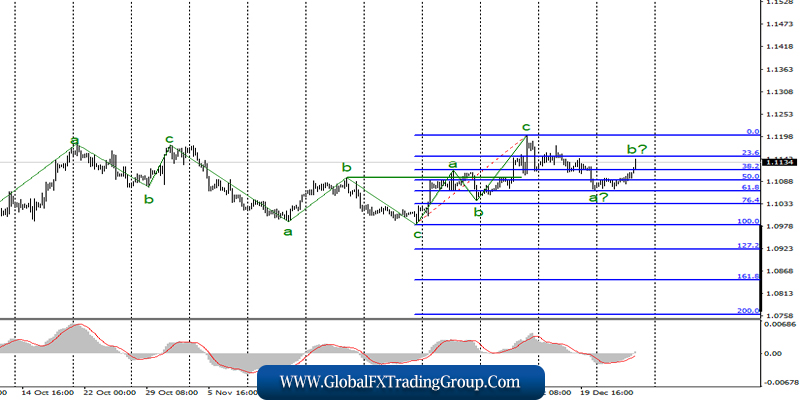

EUR / USD

On December 26, the EUR / USD pair increased by 10 basis points, but then already gained almost 40 on Friday night and morning. Are the markets recovering their previous holiday activity?

One way or another, the current wave counting at the moment involves the construction of a correctional wave b. Now, I expect the completion of the quotations departure from the lows reached in the coming days and the resumption of decline within the framework of the expected wave c since the upward trend section is considered completed at the moment.

Thus, I do not recommend selling a pair before receiving a signal about the completion of wave b. On the other hand, a successful attempt to break the maximum of December 13 will suggest the readiness of the instrument to complicate the upward trend section.

Fundamental component:

A news background for the euro-dollar instrument is missing. Not surprising for the holidays. All economic reports are postponed to 2020. Markets can expect to receive new information of a fundamental nature not earlier than the end of the New Year holidays, respectively.

Strangely enough, the Euro currency found a reason on December 27 to begin to rise in a more energetic manner than it was in the previous two or three days. Given the fact that there were no interesting messages from America or the European Union, I am inclined to believe that the so-called “New Year’s trading” has begun.

Trading, when the market is too sensitive to every new player and/or to every new open transaction. Thus, I recommend that you conduct very accurate trading these days, since it is extremely difficult to predict where the market will unfold and at what point.

General conclusions and recommendations:

The euro-dollar pair presumably completed the construction of the upward trend section. Thus, I would recommend selling the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci.

The signal from the MACD “down” will indicate the readiness of the instrument for a new decrease. At the same time, the decline may resume after the New Year given the festive mood of the market.

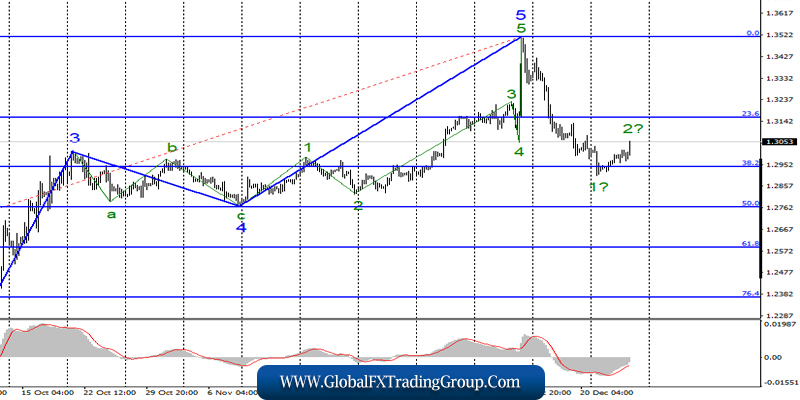

GBP / USD

On December 26, the pair GBP / USD increased by 30 basis points, and added another 70 points in the morning of December 27. Thus, it can be officially announced that the first wave as part of a new bearish trend section has completed its construction and the instrument has moved to building wave 2 or b.

If this is true, then the increase in quotations will continue with targets located near the level of 1.3160, which is equivalent to 23.6% Fibonacci. On the contrary, an unsuccessful attempt to break through this level will lead to the completion of the construction of the correctional wave and with a high degree of probability of the resumption of the decline in the pound.

Fundamental component:

There is no news background for the GBP / USD instrument. The British government went on vacation, so the key topic for the British pound – Brexit and everything related to it – it has no news feed right at the moment.

If you add to this the complete absence of economic reports, as well as the festive mood of the market, it becomes clear that you can now rely only on the wave picture or technical indicators. In addition, pound sterling is perfecting the current wave marking, and thus, are waiting for the completion of the construction of wave 2 or b .

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend resuming the sale of the instrument with targets located near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%, after completing the construction of wave 2 or b by the MACD signal “down”.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom