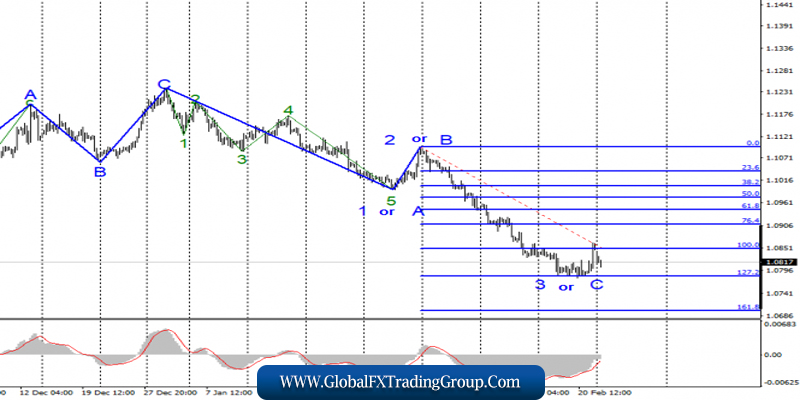

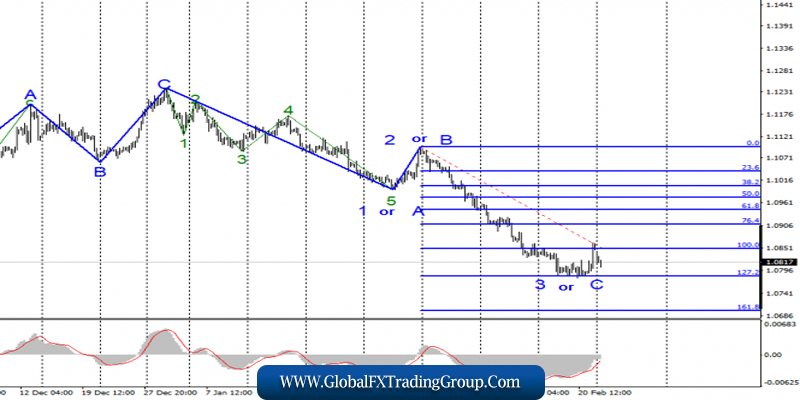

EUR / USD

On February 21, the EUR / USD pair gained about 60 basis points and began to move away from earlier lows after an unsuccessful attempt to break through the 127.2% Fibonacci level. So I guess the construction of wave 3 or C is already completed. If this is true, then the increase in quotes of the instrument will continue within the framework of either correctional wave 4 or a new upward set of waves.

However, wave 3 or C may become more complicated, the entire descending section of the trend may take a 5-wave form. Thus, I believe that a successful attempt to break through the 127.2% level will indicate that markets are ready for new instrument sales.

Fundamental component:

The news background for the EUR / USD instrument on February 21 was controversial. The reports on business activity in the manufacturing sectors of Germany, the European Union and America, as well as inflation in the EU are of greatest interest today. Thus, we can immediately say that inflation in the EU was the least interesting among other reports, amounting to 1.4% y / y.

This is exactly the figure that markets expected to see. But business activity in the manufacturing sector of Germany increased to 47.8, and in the European Union – to 49.1. Therefore, both European indicators are approaching to leave the area below 50.0, but still remain there. Due to this, it is too early to talk about a complete cure for industry in the eurozone.

Next month, business activity indices may again begin to decline. At the same time, American business activity indices were unexpectedly much worse than expectations of the currency exchange market. Meanwhile, in the sphere of production, the indicator declined to 49.4, although the previous value was much higher – 53.4. In the service sector – a decrease to 50.8.

And although absolutely all indices are inconclusive in February, the trend in America is alarming the markets and on Friday could not do without a decrease in demand for the dollar due to these statistics. On Monday, I am not expecting news from either the eurozone or America. Thus, the amplitude of trading can be very low throughout the day. The first half of the day shows that markets do not intend to continue buying euros with an empty news calendar.

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. Based on the current wave counting, I recommend waiting for a successful attempt to break through the Fibonacci level of 127.2% for new sales with targets located near the level of 1.0699, which corresponds to 161.8% Fibonacci.

GBP / USD

On February 20, GBP / USD pair gained about 75 basis points and started; thus, the construction of new correctional wave as part of the descending portion of the trend, namely the downward wave 3 or C. If the current wave count is correct, the price decline will resume in the near future as part of a wave 3 in 3 or C. At the same time, going beyond the maximum of the expected wave of 2 to 3 or C will indicate that markets are not ready for the further construction of a downward trend section.

Fundamental component:

The news background for the GBP / USD instrument on Friday was the same data on business activity in the US services and manufacturing. However, in addition to this information, there were also reports on business activity in the UK as well as preliminary for February.

It turned out that it fell to 53.3 in the service sector, but the more important index in the production sector increased to 51.9, finally leaving the region below 50.0, below which it is believed that the industry is in recession. Thus, we can assume that the British statistics increased the demand for the pound on Friday.

However, on Monday, I do not expect news and reports from the UK and the USA, and the current wave counting implies a new decrease in the instrument. Thus, without the support of the news background, the resumption of quotes reduction will be a very logical development of events.

General conclusions and recommendations:

The pound-dollar instrument construction continues downward wave 3 or C. Thus, I recommend selling the instrument with targets located near the level of 1.2767, which corresponds to 50.0% Fibonacci, on the new MACD signal “down”, which will signal the completion of the correctional upward wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom