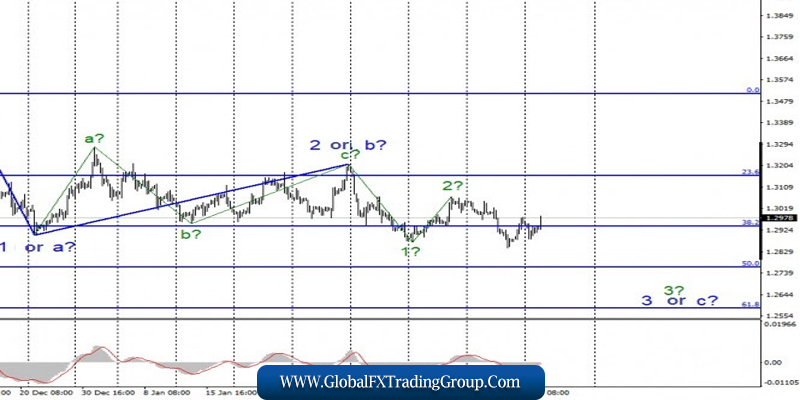

EUR/USD

On February 24, the EUR/USD pair gained about 35 basis points and continued to move away from the previously reached lows. Thus, the assumed wave 3 or C has completed its construction with a high probability. If this is true, then at least one upward wave will be built now, possibly 4. Or a set of waves as part of a new upward trend. There are no signs of resuming the construction of the descending section yet.

Fundamental component:

There was no news background for the EUR/USD instrument on February 24. Several reports from Germany and the United States that have absolutely no significance for the currency market did not have any impact on the dynamics of the instrument. Nevertheless, the markets, according to the current wave markup, continued to buy the euro at a certain point on Monday. Thus, the news background was not the reason for the increase in the instrument’s quotes.

Approximately the same pattern will be observed today, on Tuesday. Apart from the German GDP report that has already been released, I have nothing to draw your attention to. Gross Domestic Product in the fourth quarter showed a result of + 0.4% y/y and 0% q/q. These are the numbers that the markets were waiting for, so no special changes occurred after the release of this report.

Also, the size of GDP without taking into account seasonal fluctuations became known, but there were also no surprises. Market expectations of 0.3% m/m and an actual value of 0.3% y/y. Thus, the lack of news background does not contribute to the construction of impulse waves, therefore, you need to wait for more important information to make the markets move more quickly. Until then, I expect to continue building the correction wave.

General conclusions and recommendations:

The euro/dollar pair have presumably completed the construction of a descending set of waves. Based on the current wave markup, I recommend waiting for a successful attempt to break the 127.2% Fibonacci level for new sales with targets located near the mark of 1.0699, which corresponds to 161.8% Fibonacci. I do not recommend buying the tool now since it is not clear whether another descending wave 5 will be built.

GBP/USD

The GBP/USD pair lost about 20 basis points on February 24 and is still in the process of building a corrective wave 3 in 3 or C. If this is true, then the decline in quotes will resume in the near future. At the same time, a further increase in the tool will not only complicate the wave 3 in 3 or C but also require adjustments and additions to the entire wave markup. However, now the main option is to lower the quotes according to the current wave markup.

Fundamental component:

The news background for the GBP/USD instrument was also absent on Monday. The British pound continues to wait for news on Boris Johnson’s trade negotiations with the European Union and America. The results of these negotiations will determine the dynamics of the instrument not only in the coming weeks but also throughout 2020.

Let me remind you that it is at the end of this year that the final break between the EU and the UK will take place, and whether a trade deal is concluded will depend on the economic state of the UK in the coming years. So far, all that is known is that Boris Johnson and Michel Barnier insist on completely different terms of the agreement.

However, I would like to remind you that only preliminary negotiations are currently taking place, and official ones will begin only in March. Thus, information on this topic should be expected as early as next month.

General conclusions and recommendations:

The pound/dollar instrument continues to build a downward wave 3 or C. Thus, I recommend selling the instrument with targets located near the mark of 1.2767, which corresponds to 50.0% of Fibonacci, on the new MACD signal “down”, which will signal the completion of the construction of a corrective upward wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom