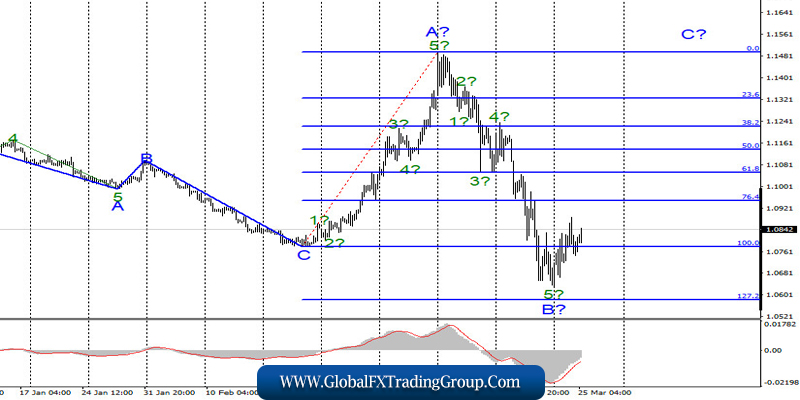

EUR/USD

On March 24, the EUR/USD pair gained about 60 more base points and continues to build the expected wave C with targets located near the 15th figure. If this is true, then the entire section of the trend that originates after February 20 will acquire a very wide horizontal view. At the same time, a successful attempt to break through the minimum of wave B may lead to a complication of the entire wave markup and a new decline in the European currency.

Fundamental component:

The news background for the EUR/USD instrument on March 24 was quite extensive. First, preliminary indicators of business activity indices in the services and manufacturing sectors were released in the European Union. In the German service sector, the decline was 18 points, while in the European Union – 24 points. The manufacturing sector has also been affected by the coronavirus.

In Germany, business activity decreased by 2.3 points, and in the European Union – by 4.4 points. In fact, almost minimal losses compared to the service sector. In America, business activity indices were also released. In the service sector, losses were recorded at 10.3 points, and in the manufacturing sector – 1.5 points. As we can see, the service sector has suffered the most from the epidemic so far.

However, this is not all. After two unsuccessful attempts to pass a bill providing assistance to the American economy for almost 2 trillion dollars, today we received information that the administration of Donald Trump and the US Congress still agreed on the need for adoption. Thus, a new vote can be held today, and within a few days, the bill may come into force. I believe that this bill, which provides for the injection of an additional $2 trillion into the economy, reduces the demand for the US currency at this time.

Markets believe that the US economy will be hit hard by the epidemic if, at the very beginning, the government takes such measures to save it. In addition, the US dollar has already grown significantly against European currencies. Markets consider it overbought.

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of a downward wave B. The entire section of the trend, which originates on February 20, takes a horizontal form, and waves A-B-C can be approximately equal in size. For now, the main scenario is to build an ascending wave C. You can buy the instrument carefully with stop-loss orders under the low of wave B.

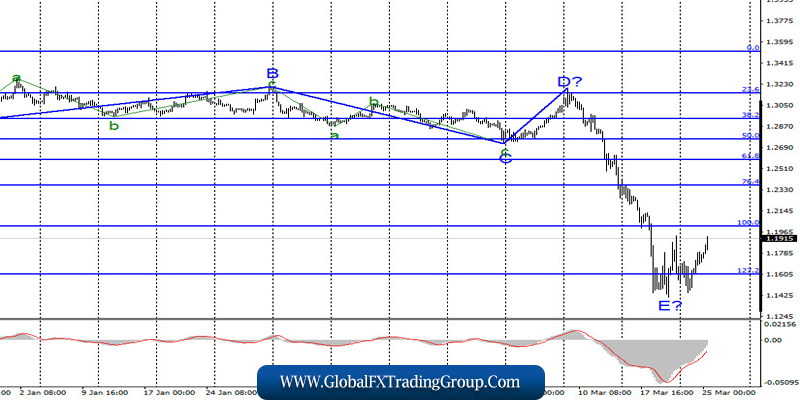

GBP/USD

The GBP/USD pair gained about 200 basis points on March 24, and this morning – another 200. Thus, I increasingly believe that the downward wave E, as well as the entire downward section of the trend, has completed its construction. If this is true, then the increase in quotes will continue as part of the construction of a new ascending set of waves, at least three-wave. The pound/dollar instrument gets good prospects for an increase in the area of 25th figure.

Fundamental component:

The news economic background for the GBP/USD instrument on Tuesday was also interesting. In the UK, business activity indices were also released in the services sector (a decrease of 17.5 points) and in the manufacturing sector (a decrease of 3.7 points). In addition, a report on inflation in Britain was released today, which showed its decline in February by 0.1% – from 1.8% to 1.7% y/y.

Markets, however, were not particularly upset by this fact and continued to sell the dollar, which now leads to an increase in the pound/dollar instrument. Thus, I believe that it is the actions of the Fed and the administration of Donald Trump that are now leading to the fact that the US currency has ceased to become more expensive.

General conclusions and recommendations:

The pound/dollar instrument also presumably completed the construction of the descending set of waves and the last wave E. Thus, now you can carefully buy the pound in the expectation of building a new ascending set of waves with targets located near the 25th figure and with stop-loss orders under the low of the wave E.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom