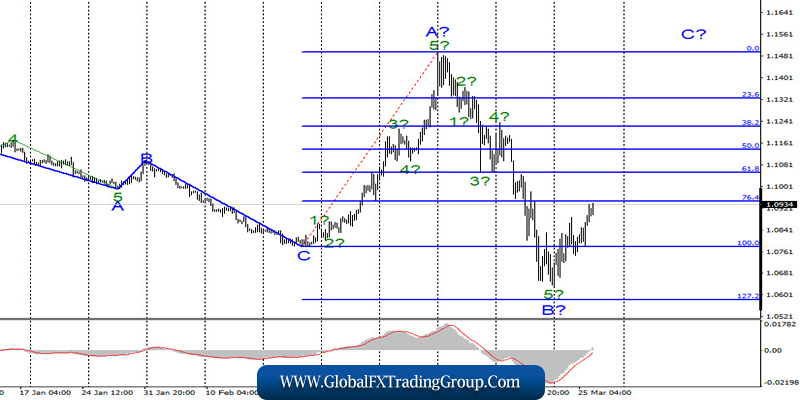

EUR / USD

On March 25, the EUR / USD pair gained about 95 basis points and continues to build the expected wave C with targets located near the 15th figure. On the morning of March 26, about 60 points were collected, so the recovery is in full swing. The current wave markup assumes the construction of a wave C is not smaller than the wave B or A. If this is true, then the increase will continue up to the 15th figure, and possibly higher. And no news background will prevent this, just as it did not prevent the Euro from falling by 850 points in wave B.

Fundamental component:

The news background for the EUR / USD instrument on March 25 was quite extensive. Several economic reports were released in Germany and the USA, however, even the usually important report on orders for durable goods, which are also significant, did not cause any reaction on the currency market.

Nevertheless, the markets continued to closely monitor the actions of the White House and the US Congress. Tonight, the decision was officially approved to provide the US economy with a stimulus package worth nearly $ 2 trillion. Thus, from my point of view, this is a factor that will put pressure on the US currency. As we can see, there is too much talk now that the US economy will lose a significant portion of growth over the past three years and roll back to the levels “before the presidency of Donald Trump.”

The US president already wants to end the quarantine as soon as possible and begin to restart the economy, which is decreasing more and more with each additional week of quarantine. And although doctors warn against opening economic borders, Trump stands his ground. At the same time, fed representative James Bullard believes that the unemployment rate in America could reach a record 30%, if the epidemic persists until the summer, up to 45 million Americans could lose their jobs.

The burden on the American government in this case will be much stronger than a few trillion dollars, since 45 additional million unemployed people need to be supported, and they will not pay taxes.

General conclusions and recommendations:

The euro/dollar pair has presumably completed the construction of a downward wave B. The entire section of the trend, which originates on February 20, takes a horizontal form, and waves A-B-C can be approximately equal in size. For now, the main scenario is to build an ascending wave C. You can buy the instrument carefully with Stop Loss orders under the low of wave B.

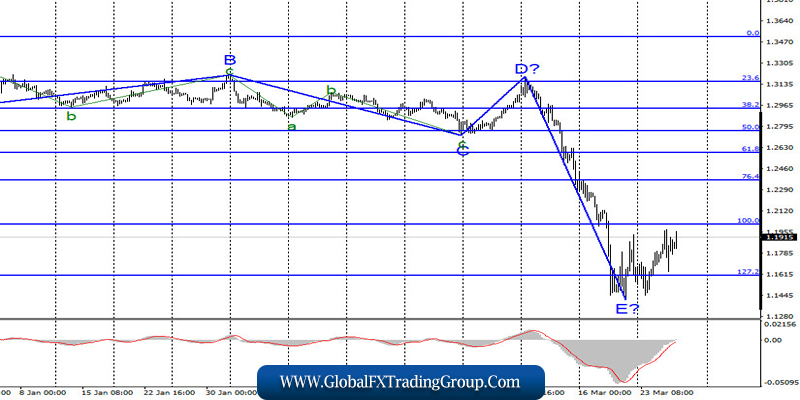

GBP / USD

On March 25, the GBP / USD pair gained about 150 basis points. Thus, I increasingly believe that the bearish wave E, as well as the entire downward trend, has completed its construction. If this is true, then the increase in quotes will continue in the framework of constructing a new ascending trend section, at least three-wave, with targets located about 25-26 figures. At the same time, the general state of the currency market can lead to unexpected reversals and make adjustments to the current wave marking.

Fundamental component:

The economic news background for the GBP / USD instrument on Wednesday came down again to general news about the spread of the COVID-2019 virus and measures taken by governments. All reports of the day, inflation in the UK, and orders for long-term goods in the USA did not attract any attention from the markets.

However, data on the continued spread of infection continues to reduce demand for the dollar. The euro and the pound take advantage of this and continue to gain ground. The US stock market also began to recover in recent days, but this did not lead to new purchases of American currency. It seems that the dollar has used all its potential for growth.

General conclusions and recommendations:

The pound / dollar instrument has also allegedly completed the construction of the downward set of waves and the last wave E. Thus, now, we can carefully buy the pound for the construction of a new upward set of waves with targets located near the 25th figure and with Stop Loss orders under the low of wave E.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom