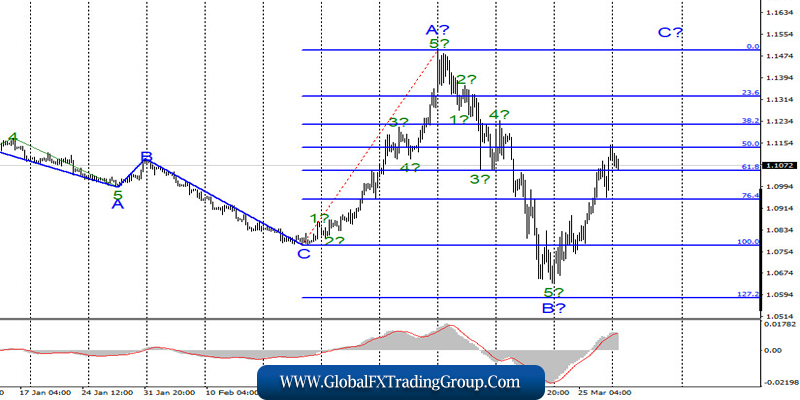

EUR/USD

On March 27, the EUR/USD pair gained about 110 more base points and thus continues to build the expected wave C as part of an ascending or horizontal section of the trend that begins on February 20. An unsuccessful attempt to break through the 50.0% Fibonacci level indicates a possible departure of quotes from the reached highs, but the entire wave C does not yet look fully completed. After the past week and all the news, the mood of the markets has clearly not improved, so the shock state remains.

Fundamental component:

The news background for the EUR/USD instrument on March 27 remains strong. The problem is that it is very difficult to determine what exactly drives the currency market. There is a lot of news coming in now. The forecasts that are heard daily from medical experts and high-ranking officials are disappointing. According to them, the world (and therefore most of the world’s countries) has not yet passed the “peak” of the epidemic.

This applies even to the most infected Italy, where there are already more than 100,000 cases of the COVID-19 virus and more than 10,000 deaths. Consequently, the number of people infected with the pandemic will continue to grow in Europe. It is also good that the really high loss of human life is not observed everywhere, but only in a few countries (Spain, France), and, for example, in Germany and Switzerland, the death rate is much lower.

The situation is no better in America, where the number of infected residents is already almost 150,000. President Donald Trump believes that if from 100,000 to 200,000 Americans die from the virus, it can be considered that the American government “did a good job”. If the White House did nothing, the number of deaths would be more than 2 million, according to Trump. It is not known what calculations the US President made, but his speech looks like an attempt to justify potentially high losses from the epidemic.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an ascending wave C. The entire section of the trend, which originates on February 20, takes a horizontal form, and waves A-B-C can be approximately equal in size. So far, the main option for the development of events is the construction of the ascending wave C. You can carefully buy the instrument with stop-loss orders under the low of wave B. The final target is 1.1500.

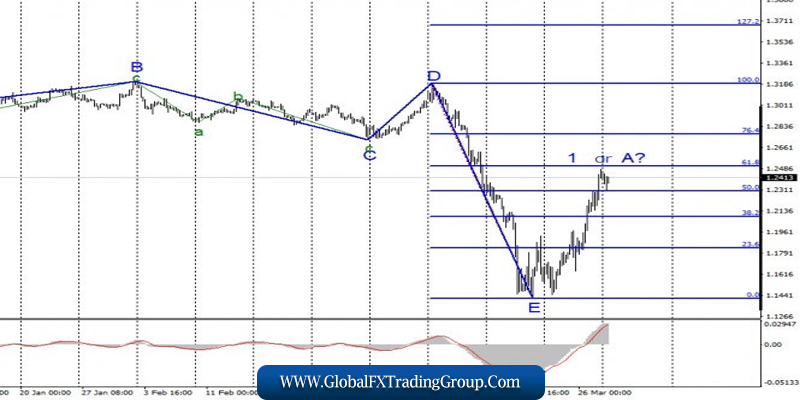

GBP/USD

The GBP/USD pair gained about 300 more base points on March 27. Thus, the construction of the expected first wave as part of a new upward trend continues. If this assumption is correct, the increase in the instrument’s quotes will continue. However, given the high activity of the market, it is difficult to say with certainty when the time will come to build a corrective wave.

Fundamental component:

The news economic background for the GBP/USD instrument on Friday was also reduced to general news about the spread of the COVID-2019 virus and measures taken by governments around the world. Other news, including economic news, is now poorly taken into account by the markets. In general, oil continues to fall in price, the US stock markets have recovered slightly, but, according to everyone, they have not yet passed the crisis phase.

Thus, we can expect new collapses in the stock markets (not only in the US). Since the recession is just beginning, the global economy will continue to slow, and recovery will not begin until the end of the epidemic. According to the forecasts of the same Donald Trump, the American economy will begin to recover no earlier than June 1. In the UK, the number of cases is 20,000.

General conclusions and recommendations:

The pound/dollar instrument has also supposedly completed the construction of the downward set of waves and the last wave E. Thus, now you can buy the pound sterling based on the construction of a new upward set of waves with targets located near the 25th figure and with stop-loss orders under the low of wave E. Already today or tomorrow, the instrument can begin to build a correctional wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom