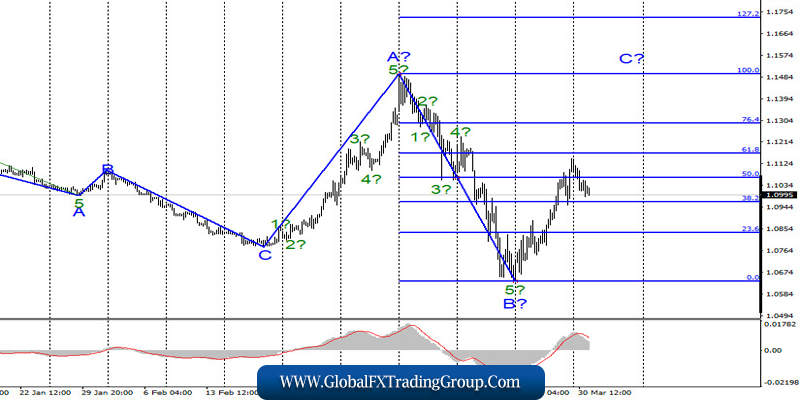

EUR / USD

On March 30, the EUR / USD pair lost about 70 basis points, and another 50 points this morning. Thus, there is reason to assume completion of construction of the first wave in the future C. If this is true, then the decline in quotes will continue within the framework of the second wave in C with targets located around 8th and 9th figures. Moreover, do not forget that wave marking may require adjustments at any time, as markets remain in a panic state.

Fundamental component:

The news background for the EUR / USD instrument on March 30 remains strong. Although in recent weeks, markets have paid much more attention not to economic reports, but to news about the coronavirus pandemic and its spread across the planet. All the world’s central banks have made decisions to stimulate their own economies. But can it be said that these actions are reflected in the charts of currency instruments? It is impossible to answer “yes” unequivocally and definitely answering “no” too.

The thing is that both large market players and small ones are now trading in a way that is not familiar to them. All the factors that usually influenced decision making do not work right now. That is why most economic reports are irrelevant now. Simply because the markets don’t pay attention to them. The coronavirus pandemic is spreading across Europe and the United States. This factor also cannot be associated with the movement of the Euro/Dollar instrument.

Thus, I believe that the movement is now as “random” as possible, in the language of programmers. Now, the reports on the economies of the EU and the US for March will be released. And most likely, we will see their continuous failures and disappointments. However, there will probably not be a clear reaction even to the March reports. Oil has been trading near its lows since 2002, which does not add optimism to the markets.

As for the ratio of wave counting to the news background, I can’t find any correlation between them now. From the current values, the instrument can move to the 15th figure, or it can start a new long decline, which will lead to a change in the wave marking.

General conclusions and recommendations:

The euro-dollar pair presumably continues to build the rising wave C, which can turn out to be very long. The internal wave structure of this wave can take a 5-wave form. I recommend buying the instrument again with the expectation of building a new impulse wave inside C after receiving the MACD signal “up”.

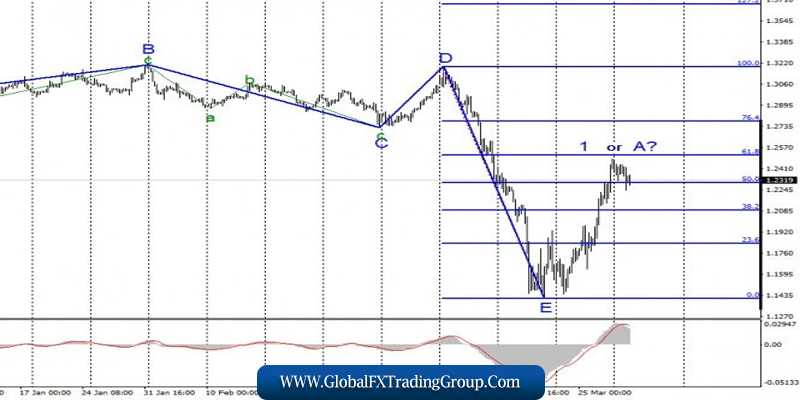

GBP / USD

On March 30, the GBP / USD pair practically did not change in price for the first time in a long time. This morning, quotes of the instrument lost about 100 points, which is not very much for the pound at the moment. Thus, there are certain grounds for assuming completion of the construction of wave 1 or A, but at the same time, this wave can continue its construction and take a more complex form. In any case, wave marking may require additions and corrections at any time, as markets continue to be in a panic state, although in recent days the amplitude of the instrument has slightly decreased.

Fundamental component:

There was no news economic background for the GBP / USD instrument on Monday. However, as I said above, markets now rarely respond to economic reports. Thus, the fact that they are practically absent now is not particularly upsetting. This morning, a fourth quarter GDP report was released in Britain. The value of GDP was + 1.1% y / y and 0.0% m / m. This is exactly what the markets expected to see.

The British pound declined slightly in price this morning, but can this decline be linked to the release of the GDP report? That is unlikely. Thus, it is now more dependent on the growth rate of the COVID-19 virus in the United States. If the pace accelerates, it is highly likely that the demand for the US currency will remain low.

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward wave, which, presumably, is part of the new upward trend section. Thus, the British pound will be able to make purchases after the completion of the proposed correctional wave or in the case of a successful attempt to break through the 61.8% Fibonacci level. The breakdown of the 50.0% Fibonacci level will indicate the willingness of markets to build a correctional wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom