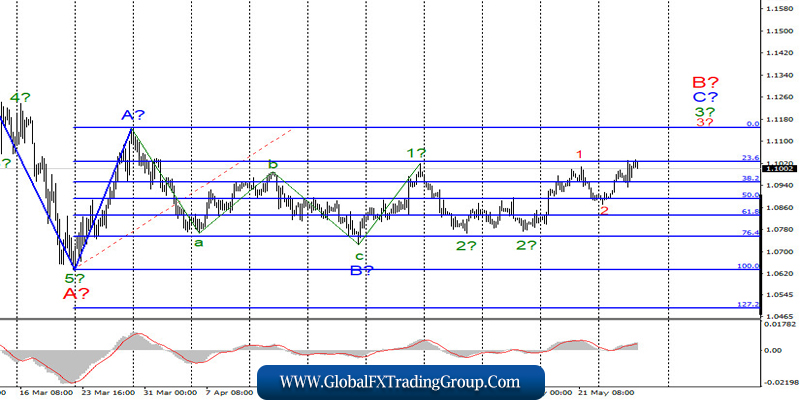

EUR / USD

On May 27, the EUR/USD pair gained about 25 more basis points and, thus, presumably continues to build wave 3 in C to B of the upward trend section. The instrument finally updated the peak of wave 1, which indirectly confirmed its readiness to continue raising quotes. In addition, its own wave structure is visible inside the wave 3 in C in B and now, the internal wave 3 continues to build. Thus, a successful attempt to break through the 23.6% Fibonacci level will indicate the readiness of the markets to buy the Euro.

Fundamental component:

On Wednesday, there was no economic news in the US and the European Union again. But there was a mass of political and geopolitical news and events. First of all, the next plan of the European Commission to save the falling European economy must be noted. This time, the Ursula von der Leyen organization offered a fund of 750 billion euros, which will be attracted to the debt markets. These 750 billion euros will be allocated to grants (66%) and soft loans (33%) and will be provided to the most affected sectors of the economy and EU countries.

Let me remind you that the previous plan to save the economy from the consequences of the crisis, which was proposed by Merkel and Macron, was somehow very quickly blocked by the northern countries, which unequivocally spoke out against paying for assistance to the southern countries. In fact, the new plan is not different from the previous one. The amount has increased, the sources of financing are also debt markets, and funds will be sent to those countries that have been most affected by the pandemic.

In other words, according to the plan of the European Commission, the problems of Italy, Spain, and Portugal will have to be paid for by the stronger economically Northern countries, Germany, Austria, and the Scandinavian countries. Naturally, the new plan immediately faced the same criticism as the previous one.

Moreover, about 500 billion euros want to be provided in the form of grants, that is, funds that will not need to be returned. Of the 750 billion, about 300 will go to Italy and Spain. The European Commission is going to return the borrowed funds after 2028 by increasing taxes and contributions of EU member States to the common Treasury.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0% for each new up signal MACD. The peak of wave 1 has been updated, and a successful attempt to break the level of 1.1028 will help the euro continue to increase, while an unsuccessful attempt will lead the quotes to move away from the highs reached.

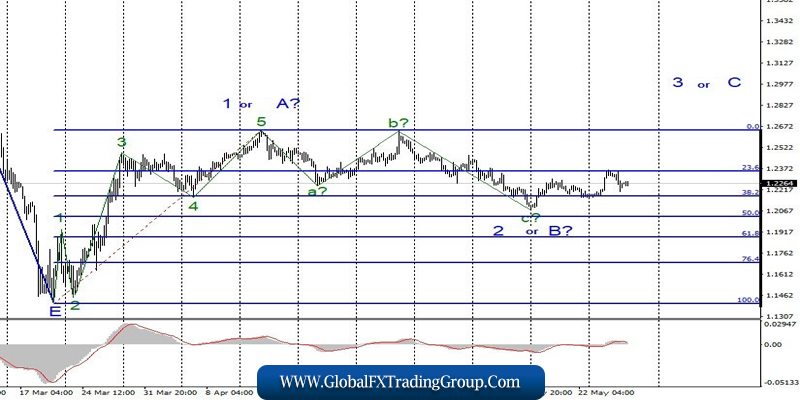

GBP / USD

On May 27, the GBP/USD pair lost about 80 basis points and, thus, made an unsuccessful attempt to break through the 23.6% Fibonacci level. The construction of the proposed wave 3 or C is postponed once again, and the wave marking itself can take a more complex form. In particular, the internal structure of wave 2 or B, which can take a 5-wave horizontal form, can become significantly more complicated. On the other hand, a successful attempt to break through the low wave C in 2 or B will indicate the need to make adjustments to the wave markup.

Fundamental component:

On Wednesday, the news background was still missing in the UK. Therefore, the attention of the markets was more focused on events in the USA and China, which seem to be seriously preparing for the Cold War. Today, there will be no reports again in the UK, but some important ones will come out in the United States. In particular, GDP for the first quarter.

The market expectations are -4.8% y / y and the various categories of the report on orders for durable goods can lose from 10% to 20%, which is a lot. According to these forecasts, the US currency may lose some of the demand, but on the contrary, we see an increase in demand for the dollar on Thursday morning.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around 26th and 27th figures, based on the construction of wave 3 or C or wave d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. Meanwhile, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom