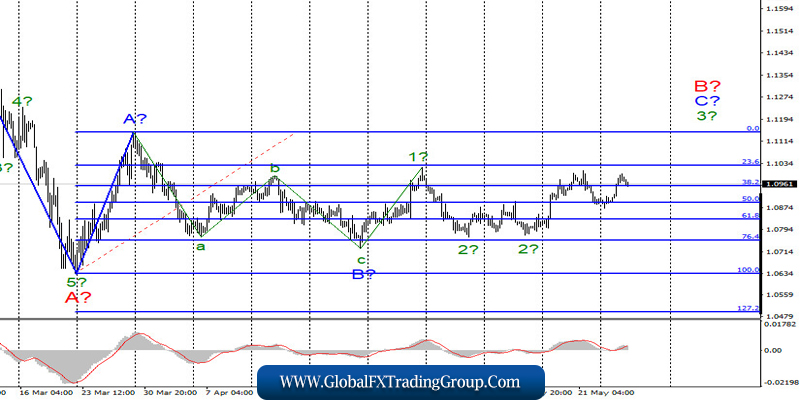

EUR / USD

On May 26, the EUR/USD pair gained about 85 base points and, thus, supposedly resumed the construction of wave 3 in C in B of the upward trend section. The instrument still cannot make a successful attempt to break through the maximum of wave 1, which makes it difficult to further increase the quotes. Nevertheless, the current wave marking involves the construction of an ascending wave. At the same time, another unsuccessful attempt to break through the peak of wave 1 can lead to a significant complication of the entire wave marking.

Fundamental component:

There was no economic news in the US and the European Union on Tuesday. However, markets are now fully focused on the development of the situation between the US and China. In recent months, markets have been actively discussing Washington’s possible actions against China, since, according to the former, it is Beijing that is guilty of infecting the whole world with a coronavirus and must be punished for it.

However, a new difficulty has now appeared between the countries. Beijing is going to pass a national security law in Hong Kong that will give it much more power in this Autonomous region. This is opposed by America, which believes that Hong Kong should remain as a global financial center, independent of the mood of Beijing. Hong Kong itself continues to protest against the actions of the Chinese government. Mass riots and rallies began before the COVID-2019 epidemic.

Now they have resumed. Washington threatens China with new sanctions, this time against companies and various financial institutions, and Hong Kong itself may lose a large number of preferences granted to it by America. So far, of course, this is just talk and threats, but at any moment they can become concrete actions, which, of course, will negatively affect the economy of these countries and slow down the recovery of global GDP. Donald Trump personally warned China yesterday that if the law is passed, the States will respond “very powerfully”.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0% for each new up signal MACD. The low of wave B has not been updated, so the current wave markup still retains its integrity.

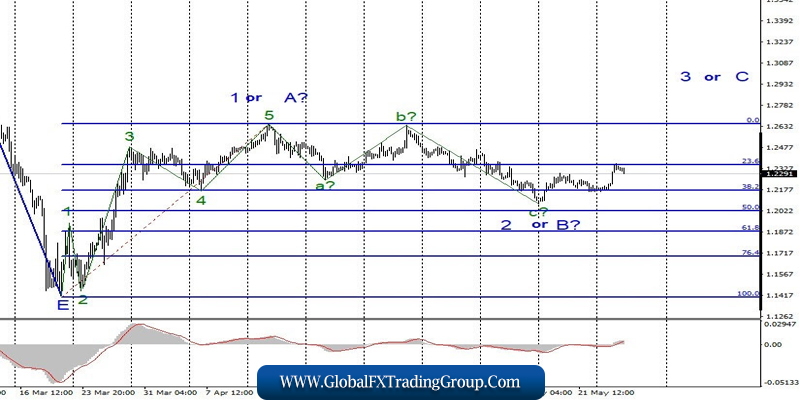

GBP / USD

On May 26, the GBP/USD pair gained 150 basis points and thus continued building the expected wave 3 or C. The increase in the price of the instrument may continue with the targets located around 1.2630, which is equal to the peak of wave b or the peak of wave 1 or A. At the same time, the entire wave 2 or B can take on a more complex 5-wave horizontal appearance. However, even in this case, it is expected to build an upward wave consisting of 2 or B.

Fundamental component:

On Tuesday, there were no economic reports in the UK again. No economic events are planned for America or Britain today either. Nevertheless, the US will release important data on GDP for the first quarter, as well as on applications for unemployment benefits tomorrow. And while there are no reports, the markets are studying in detail the information that is already available.

This information is not specific. For example, markets are seriously worried about the possible introduction by the Bank of England of negative rates. But this is not a decision yet and selling the Briton on the basis of such vague rumors is not advisable.

General conclusions and recommendations:

The pound / dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying a pound with goals located around the 26th and 27th figures, based on the construction of wave 3 or C or wave d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. A successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom