EUR / USD

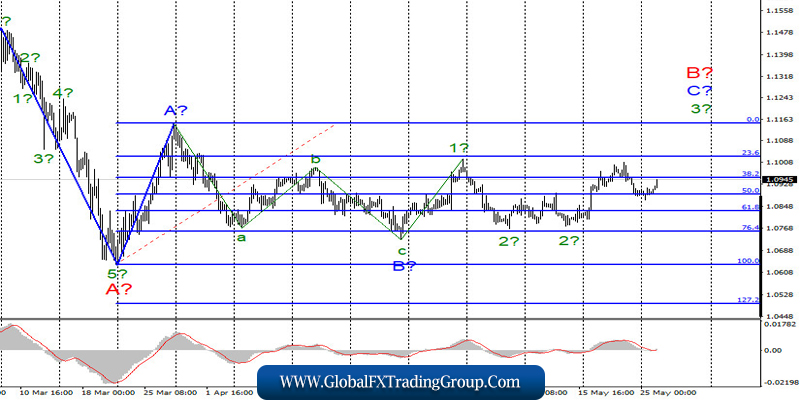

On May 25, the EUR/USD pair literally lost a few basic points, so the wave markings did not suffer any changes. However, this pair began to rise this morning, which gives hope for the implementation of the current wave pattern, which involves the construction of wave 3 in C in B. If this is true, then the euro / dollar instrument will make a successful attempt to break the peak of wave 1 in C to B and continue to rise to the 11th and 12th figures in the near future.

Fundamental component:

On Monday, there was no news of the economic plan in the US and the European Union. But this is not important, since the markets are now closely monitoring the development of the situation between the US and China. Mostly, they have nothing more to watch now. Given the fact that both instruments have recently been traded in different directions, it can hardly be said that the topic of the next confrontation between China and the United States is the reason for the movement of any instrument on either side.

However, it is also impossible to make a conclusion that the subject is irrelevant. It does, but in the long run. After all, the start of a new trade war, the introduction of sanctions, duties, the introduction of various bans and restrictions in the interaction of these two countries, not to mention the “cold war”, which representatives of China have been talking about lately, will negatively affect the world economy. First of all, of course, in Chinese and American, but these countries have a huge impact on the whole world, so their confrontation will affect almost any other country in the world. But whether the world is ready for a new confrontation between the two giants is a big question. The coronavirus pandemic, by and large, is not over.

Although the COVID-2019 vaccine may be developed and put into commercial production in America in the fall, it will be several months before all residents of each country will be vaccinated. So 2020 will in any case be the “year of the coronavirus” and a huge decline in every country. The best that countries can expect is a slight recovery in the third and fourth quarters. However, a new conflict between the US and China may negate these weak prospects for recovery.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0% for each new up signal MACD. The low of wave B has not been updated, so the current wave counting is still intact.

GBP / USD

On May 25, the GBP/USD pair literally gained several basis points, but already added about 100 at morning trading on Tuesday. Thus, the markets started implementing wave marking, which implies building wave d as part of 2 or B or wave 3 or C of the upward trend section. In any case, I expect an increase in the quotes of this pair to the level of 0.0% by Fibonacci or slightly lower, if the wave is corrective in the composition of 2 or B.

Fundamental component:

There were no economic reports in the UK on Monday. To date, no reports are planned in America or Britain. Tomorrow, the news picture will not change either. The only thing that markets now have is daily updated information on the confrontation between China and the United States, which is indirectly related to the British, and generally does not particularly affect the movement of instruments. Britain is also interested in the topic of negotiations between Brussels and London, but now there is no new information on it.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying a pound with goals located around 26th and 27th figures, based on the construction of wave 3 or C or d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. On the other hand, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom