EUR/USD

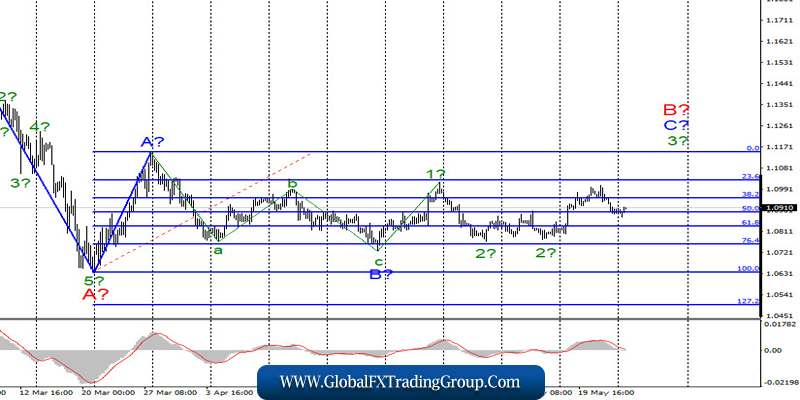

On May 22, the euro/dollar pair lost another 55 basis points. Thus, the instrument continues to move, which contradicts the current wave markup, which assumes the construction of an upward wave 3 or C or B. Either the expected wave 2 or C or B will become more complicated, or the increase in quotes should resume today or tomorrow. A successful attempt to break through low wave 2 or low wave B will indicate the complexity of the entire wave markup.

Fundamental component:

There were no important reports or events in the European Union or America on Friday. The US dollar was in demand in the foreign exchange market, but I can’t conclude that it was caused by anything. Recently, the market is swarming with a huge amount of different information, arguments, opinions, guesses, forecasts. Moreover, it is quite difficult to make an unambiguous conclusion about what awaits the world economy as a whole or the European economy separately.

In times of another crisis, there are a huge number of factors that affect or may affect a particular pair. However, as we can see, after almost a month of shock, the markets recovered and after that, the instrument is trading in a range of about 250 points wide. The movement of this nature began on April 6 and has been going on for more than a month and a half, respectively. Meanwhile, the American and European economies continue to suffer losses. According to various forecasts of economists, each will lose from 5% to 10% in the first half of the year.

In addition, unemployment rates are rising, and central banks need more and more stimulus assistance. Also, US and UK banks may even resort to negative rates, but this is just speculation by economists. On Monday, the European Union and America again have no news. Donald Trump is silent, there is no news on the US-China standoff, no new data from the White House or the US Congress.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C or B. Thus, I recommend buying a tool with targets located, as before, around the mark of 1.1148, which is equal to 0.0% of the Fibonacci level on the new “up” signal of the MACD. The low of wave B has not been updated, so the current wave markup still retains its integrity.

GBP/USD

The pound/dollar pair lost another 60 basis points on May 22, but the changes in recent days are too small to affect the current wave markup. Thus, at the moment, I conclude that the construction of the expected wave 3 or C, the upward section of the trend, which originates on March 19, continues. The price increase may resume with targets located near the peak of wave 1 or A and higher. At the same time, the alternative assumes a significant complication of wave 2 or B, which can take a 5-wave horizontal form. However, in this case, I also expect an increase in quotes with targets located around 26 figures within the internal wave of 2 or B.

Fundamental component:

In the UK, data on retail sales in April was released on Friday. This report showed how bad things are in the UK, as it lost almost 23% y/y and 18% m/m when fuel sales were taken into account. Excluding fuel sales, the cuts were -18.4% y/y and 15.2% m/m. On the one hand, the same amount of reduction is recorded in America, on the other hand – in any case, such figures can not cause the growth of the British currency.

General conclusions and recommendations:

The pound/dollar instrument has presumably completed the construction of the second wave of a new upward trend. So, now I recommend buying the pound with goals around 26 and 27 figures, in the expectation of building a wave 3 or C or d or 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. A successful attempt to break the mark of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom