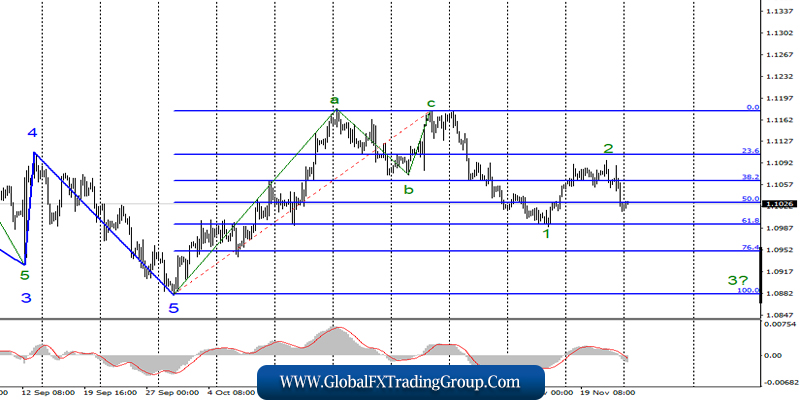

EUR / USD

November 22 ended for the pair EUR / USD with the loss of 40 basis points. Thus, the alleged wave 2 is still considered completed. If this is true, then the quotes of the pair will continue to decline with targets located near the 9th figure within wave 3 .

At the same time, it should be noted that the trend section, which began on October 31, may well take a 3-waveform, and the instrument – is unlikely to continue its decline under the 9th figure. However, at the moment, I expect to build a full-fledged downward trend section with updating the previous minimums of the euro-dollar instrument.

Fundamental component:

On Friday, the news background for the euro-dollar instrument was strong enough. There were a lot of economic reports and a speech by ECB Chairman Christine Lagarde. However, all economic reports which were related to business activity in the services and manufacturing sectors of the USA and the European Union, and the data were unambiguous.

Moreover, business activity in the EU industry remained at a low level (46.6), while in the services sector, it decreased compared to October (51.5). In the US, business activity in the manufacturing sector grew to 52.2, and in the service sector – rose to 51.6.

The consumer confidence index in America rose to 96.8. ECB President Christine Lagarde, during her first speech on the monetary policy of the European Union, said that major changes are needed. She also said that threats to the global economy are growing and trade wars do not stop, leading to a strong reduction in global growth. Insufficient investments by European countries do not provide an opportunity to fully resist the economic downward turn.

Thus, the European economy needs additional stimulation. Christine Lagarde almost openly stated that there will be changes, and that they will be aimed at supporting the EU economy. General conclusions and recommendations: The euro-dollar pair allegedly completed the construction of the proposed wave 2.

Thus, I now recommend selling the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci. The MACD indicator signal “down” indicated the readiness of the markets for the sale of the instrument.

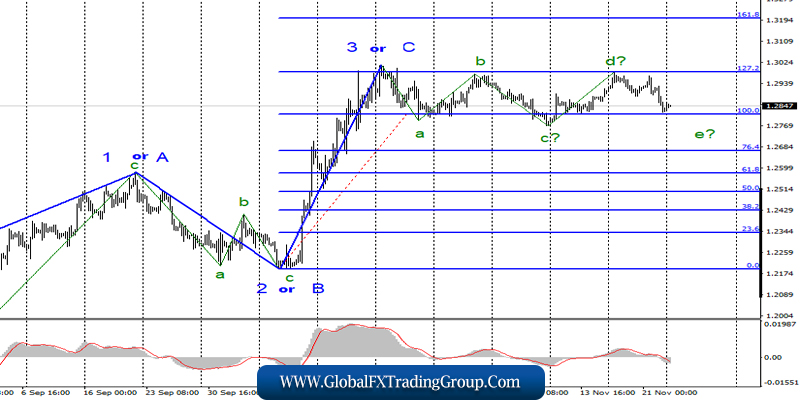

GBP / USD

On November 22, the GBP/USD pair lost about 75 basis points, fully adhering to the current wave marking, which implies a decline in the instrument as part of the construction of wave e.

Thus, markets can continue to sell the instrument on Monday and Tuesday, as wave e does not yet appear complete. At the same time, the question now is, what awaits the pound-dollar pair after the completion of wave e? Logically, this is a new upward trend section. However, the news background remains completely ambiguous for the pair.

More likely not even in favor of the pound, given the latest economic reports. Thus, it will be very difficult for markets to find reasons to build a new rising wave.

Fundamental component:

The news background for the GBP/USD instrument on Friday showed that there are serious problems with business activity in the UK manufacturing and services sectors, which will negatively affect industrial production, GDP, inflation, and wages.

Recent reports on these indicators have already shown a significant decrease or mismatch with higher market expectations. The results of the current month may turn out to be even worse, as business activity in both areas fell below 50.0. Thus, both the service sector and the production sector are now in decline.

This is enough for the pound to start a new downward trend, as economic reports in America are much better. On Monday, November 25, the news calendar in the UK, Germany, the European Union and the USA does not contain interesting reports.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can complicate this part of the trend and become the basis for new purchases of the instrument with targets located near the calculated level of 1.3199, which equates to 161.8% Fibonacci. The working option, on the other hand, provides for a decline to around 1.2770.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom