EUR / USD

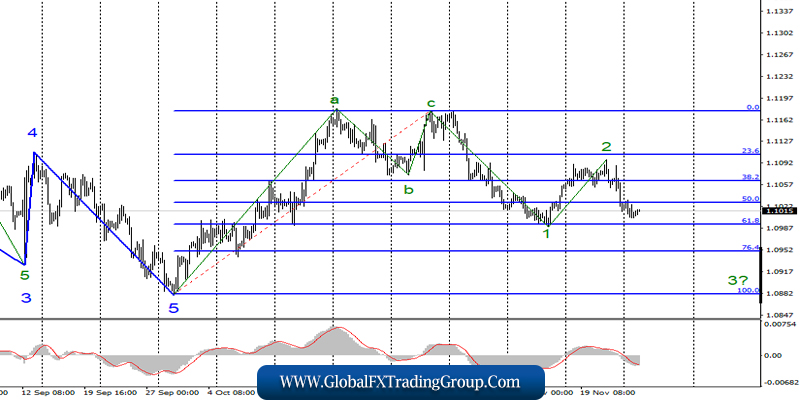

November 25 ended for the pair EUR / USD with the loss of 10 basis points, and the total amplitude did not exceed 30 points. Thus, we can say with confidence that nothing interesting happened on Monday in the currency exchange market. Based on the current wave marking of the instrument, the proposed wave 3 continues its construction, and wave 2 is still considered completed.

If this assumption is correct, then the quotation of the instrument will continue to decline with targets located near the 9th figure. On the other hand, a successful attempt to break through the 61.8% Fibonacci level and the low of wave 1 will indicate the willingness of the markets to further decline.

Fundamental component:

There was no news background for the euro-dollar instrument on Monday. There were no economic reports, and markets continue to discuss data from the trade battlefields between the United States and China. All the latest information can be called extremely controversial.

Meanwhile, the markets have witnessed both Donald Trump’s friendly statements towards China and information about the Senate’s approval of the Hong Kong Human Rights Act, which China perceives as Washington’s direct intervention in China’s domestic policy. There was also information that the signing of the “phase one” agreement would take place no earlier than 2020, since the parties could not agree on some key issues.

All this information is regularly diluted with reports of a “good and productive” negotiation process and statements by US President Trump about the introduction of new duties, if China does not sign a deal such as “how profitable America is.” Well, the last message says that Vice Premier of the State Council of the PRC Liu He, Robert Lighthizer and Stephen Mnuchin “reached an understanding on solving the corresponding problems.”

Although it is not yet reported when the agreement will be signed. Did the parties make mutual concessions to each other too? It is unknown. Today, the markets will not receive a single economic report again, so I expect the continuation of a calm trading and movements of the euro-dollar instrument.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the construction of the alleged wave 2. Thus, I now recommend to remain in the sales of the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci. An unsuccessful attempt to break through the 61.8% Fibonacci level may lead to quotes moving away from the lows reached, but without building an upward wave.

GBP / USD

On November 25, the GBP / USD pair gained about 60 basis points and made an unsuccessful attempt to break through the 100.0% Fibonacci level. However, the proposed wave e does not seem to be completed at the moment, so I expect a resumption of the decline in the quotations of the instrument, a successful attempt to break through the level of 100.0%, and decline to around 1.2770 or a little lower.

These are the options that are being considered now. On the other hand, a successful attempt to break through the 127.2% Fibonacci level will indicate the readiness of the markets to resume buying the instrument, as well as the resumption of the construction of the upward trend section. Only in this case, I recommend returning to the consideration of purchases of the British pound.

Fundamental component:

The news background for the GBP / USD instrument on Monday remained generally negative, although no economic reports were released that day. However, past economic reports leave no doubt: the UK economy is slowing and slowing at a fairly high pace. In principle, for the “Briton”, it’s even good that the markets stubbornly continue to wait for the parliamentary elections, which will take place only after two and a half weeks, and do not respond to economic news.

According to the latest information from the election campaigns, the Conservative Party continues to lead in popularity ratings among the population and even, according to some studies, increases the gap between the Labor Party. The remaining political forces are far from the 2 ruling parties and will not compete with them.

Only Social Democrats can get about 15% of the vote, the rest are unlikely to gain more than 4-5%. Thus, the probability of a conservative victory is growing, which is very pleasing to the markets. At the same time, few people want to buy the pound again on the basis of the growing probability of Johnson’s party winning.

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can complicate this part of the trend and become the basis for new purchases of the instrument with targets located near the calculated level of 1.3199, which equates to 161.8% Fibonacci. The developing option, in turn, provides for a decrease to around 1.2770.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom