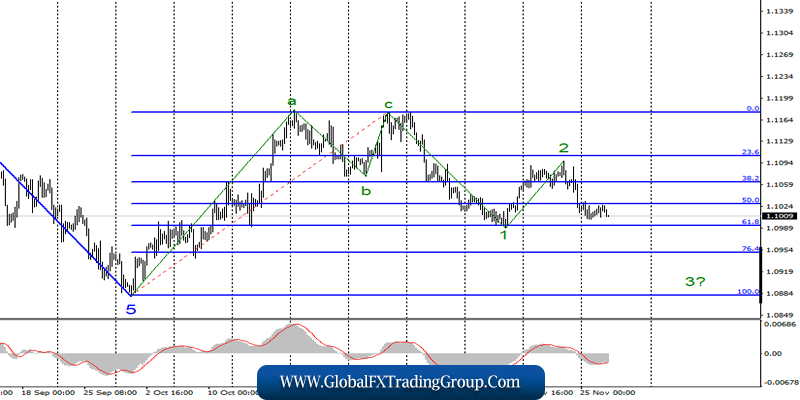

EUR / USD

November 26 ended for the EUR / USD pair with an increase of 10 basis points, however, such a change did not affect the current wave marking, which suggests the continuation of the construction of the bearish trend section within wave 3 with targets located under the 9th figure.

If this is true, then a successful attempt to break through the minimum of wave 1, as well as the Fibonacci level of 61.8%, which will indicate the willingness of markets to further reduce the instrument. A failed attempt will lead to quotes moving away from the minimums reached.

Fundamental component:

On Tuesday, there were no news background for the euro-dollar instrument again. There were also no economic reports again, and markets continue to discuss data from the trade battlefields between the United States and China. Despite the fact that both sides continue to assure everyone that the negotiations are moving successfully, and to assure that an agreement will be signed in the near future, so far it has not been signed.

On December 15, Donald Trump will have to resolve the issue of introducing additional duties on imports from China in the amount of $ 160 billion. It is expected that if the deal is not signed by this time, an escalation of the trade conflict will take place, which is definitely not beneficial to anyone this time – neither America nor China.

If Trump introduces new duties, this will essentially push the negotiation process back, if at all it is not necessary to start all negotiations from scratch. Thus, you can absolutely forget about the deal in 2019. At the same time, the US president will not be able to simply postpone the introduction of additional duties once again, he will need to justify it somehow.

Moreover, if China feels weak, it will be even more impudent to behave in negotiations, realizing that time works for it. Thus, I believe that if no agreement is signed before December 15, Trump will nevertheless introduce new duties and will further worsen the relations between Beijing and Washington.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the construction of the alleged wave 2. Thus, I now recommend to remain in the sales of the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci. On the other hand, an unsuccessful attempt to break through the 61.8% Fibonacci level may lead to quotes moving away from the lows reached, but without building an upward wave.

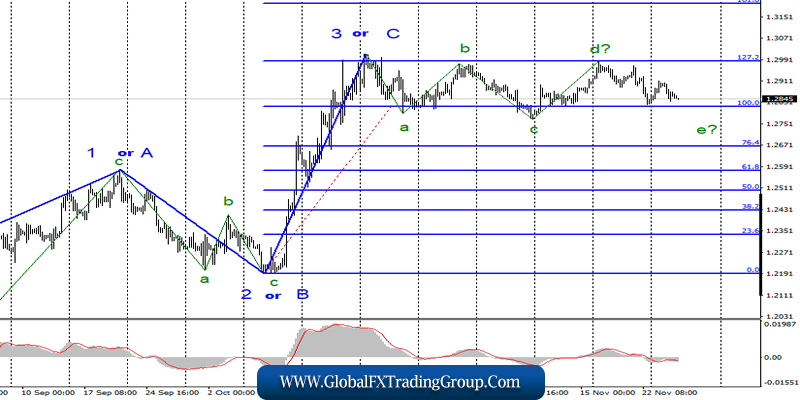

GBP / USD

On November 26, GBP / USD pair lost about 40 basis points and thus resumed the construction of a bearish wave e. However, another unsuccessful attempt to break through the 100.0% Fibonacci level may cause quotes to move away from the reached minimums again, although the targets of the e wave are located below this level.

After the completion of the construction of wave e, either wave 5 is expected to be constructed with a complication of the upward trend section, or a new horizontal correctional wave structure.

Fundamental component:

On Tuesday, there was no news background for the GBP / USD instrument and the key date remains December 12, when the UK Parliament elections will be held. Today, in America, several interesting economic reports will be released at once, which can help both instruments demonstrate more active movements.

The most interesting data will concern third quarter GDP and October durable goods orders. These reports can have a strong impact on the course of trading on November 27. The only question is what kind of market reaction they will cause.

To continue the development of their wave patterns, both the euro and the pound need the US dollar to receive support. If, accordingly, reports from America are strong, then the American currency can get support. Otherwise, trading today may take place without compliance with the wave markings.

General conclusions and recommendations:

The pound / dollar instrument continues to build a horizontal trend section. Thus, now, I still expect the quotes of the pair to decline to around 1.2770, after which the wave pattern may require adjustments and additions. I recommend you not to buy a pair earlier than a successful attempt to break through the 127.2% Fibonacci level, which will indicate the willingness of the markets to build a new impulsive rising wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom