EUR / USD

Monday, October 28, ended for the EUR / USD pair with an increase of 15 basis points and went completely in a newsletter-less mode. Thus, the current wave layout has not suffered any major changes, if only because market activity now remains very low.

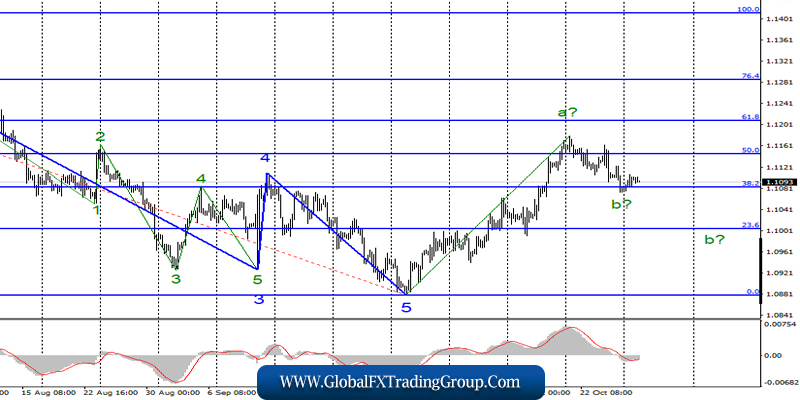

The expected wave b can already be completed, in favor of which an unsuccessful attempt to break through the 38.2% Fibonacci level, as well as excellent visibility of the three waves inside this same b, speaks in favor. If this assumption is true, then the increase in quotations of the instrument will resume directly from current positions with targets located above 12 figures in the framework of wave c.

Fundamental component:

The news background for the EUR / USD pair remains missing after Thursday of last week. There is nothing interesting, except for the press conference summarizing the 8-year rule of the ECB, Mario Draghi, although a press conference, did not happen on Monday. The same picture will be on Tuesday, which is today.

Not a single scheduled report. Thus, low market activity is likely to continue today. However, tomorrow, several important reports in America will be released immediately and the results of the Fed meeting will become known. Thus, it is tomorrow that we will be entitled to count on the strong movement of the euro-dollar pair.

It is necessary for the eurocurrency to keep the level of 38.2% so that the wave marking from the three-wave upward does not transform a complex downward. However, it is the news background that can dramatically affect both the wave pattern and the mood of the currency market.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves and completed the construction of wave a. Thus, I recommend buying the instrument after the completion of building wave b with targets located about 12 figures and above.

Nevertheless, an unsuccessful attempt to break through the level of 1.1082 indirectly indicates the readiness of the markets for a new increase.

GBP / USD

On October 28, the GBP / USD pair gained about 40 basis points, while remaining at the Fibonacci level of 100.0%. Meanwhile, wave 3 or C is currently considered complete. If this assumption is correct, then a breakthrough of 100.0% will be in a matter of time, after which the instrument will continue to decline within either wave 4 or a new downward trend section.

But anyway, the continuation of the decline in the pound is now expected. Considering an alternative option, involving the continuation of the construction of the upward trend section, is only recommended after a successful attempt to break through the level of 127.2% Fibonacci.

Fundamental component:

If the re-election to the British Parliament will take place, it will not be in the near future and not according to the “light” scenario. The “light” scenario involves the proposal for early elections to be voted on by the House of Commons and the adoption of this option by deputies with approval of the proposed date.

Yesterday, such an “easy” scenario failed for the third time. Deputies, in turn, refused the proposal of Boris Johnson to hold elections on December 12. Thus, the Prime Minister will have to look for workarounds for the early elections, which, however, also do not give any guarantees, because there is simply no other way to get out of the political “dead end”.

This will have a positive or negative impact on the whole of Brexit and the UK – the second question. However, under current conditions. Brexit may drag out not only for three additional months, but also for three additional years, because it is still not visible due to which the UK exit from the EU can be carried out.

The parliament is also against all the proposed agreements with the European Union, and against holding re-elections, which makes it impossible to change the composition to a more accommodating one. Dead end. Thus, we look forward to continuing this series.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. An unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline.

Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument. Now, I recommend looking in the direction of sales.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom