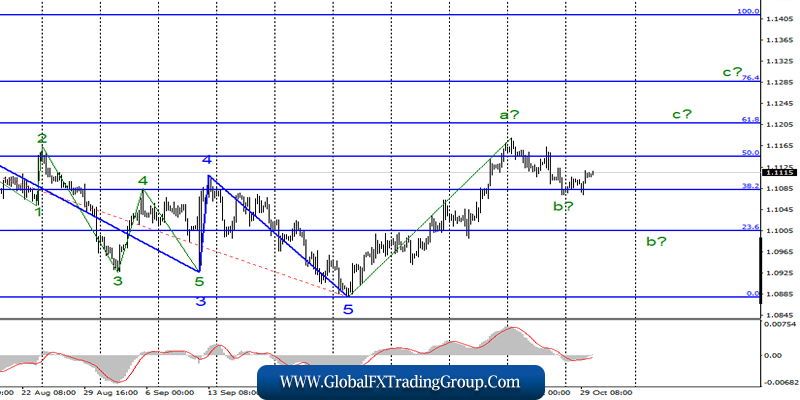

EUR / USD

October 29 ended for the pair EUR / USD with an increase of another 15 basis points. There was complete silence in the news broadcast. However, the instrument made the second unsuccessful attempt to break through the 38.2% Fibonacci level, and thus, the estimated wave b could really complete its construction near the indicated level.

If this is true, then the increase in quotations of the euro-dollar pair will continue with targets located about 12 figures and above. Just today, the news background can support the implementation of this option, which at this stage is considered as the main one.

Fundamental component:

The news background of the past day is impossible to describe since it was simply absent. In the last week and a half, there has been very little news and economic reports. Today, the situation is expected to change, but only in America.

There will still be a lull in the EU while in the US, there will be a third quarter GDP report, a third quarter personal consumption spending index and ADP data on changes in private sector employment in October.

The first two reports will be non-final; accordingly, markets may leave them without due attention. Moreover, the fateful Fed meeting will probably take place tonight, at which it will probably announce a rate cut, which may be the last in the current cycle of easing monetary policy.

However, if the markets feel that the Fed is not ready to “take a break” it will be great news for the current wave picture, which just assumes the construction of an upward wave C and needs a news background that supports the euro.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves and completed the construction of wave a. I recommend buying the instrument after the completion of building wave b with targets located about 12 figures and above.

Two unsuccessful attempts to break the level of 1.1082 indirectly indicate the readiness of markets to build an upward wave.

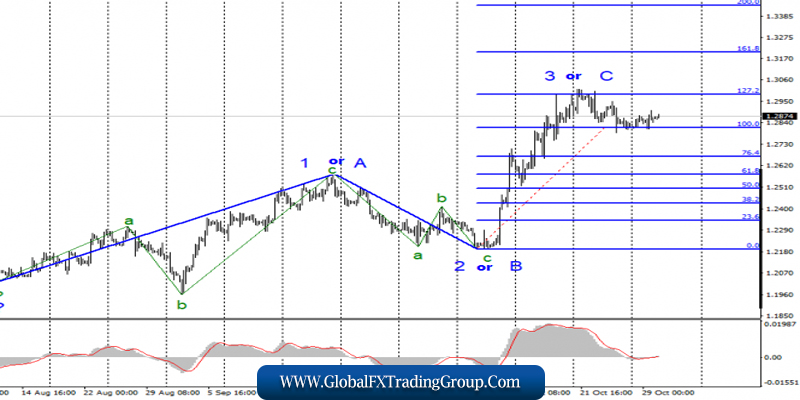

GBP / USD

On October 29, the pair GBP / USD did not gain and did not lose a single point. A third attempt to break the level of 100.0% also ended in failure, which indirectly speaks in favor of resuming the construction of prospective wave 3 or C.

However, given the general decline in market activity in recent days, I would not draw such hasty conclusions. I can be certain with the transition of the currency market to new purchases above the Fibonacci level of 127.2%, and the willingness to sell the pound sterling – below the Fibonacci level of 100.0%.

Fundamental component:

Brexit in the UK is moving into a new stage, the stage of re-election to Parliament. However, only in the United Kingdom and in the current conditions such a pun possible: on Monday, the Parliament refused early elections on December 12, and on Tuesday – agreed to them.

Yes, Brexit’s last opportunity to formally withdraw without a deal is until October 31, as Labor leader Jeremy Corbyn announced earlier, but the situation from the outside looks comical anyway. Now, the Parliament can already be dissolved in the coming days, and over the next five weeks, active election and campaigning campaigns will be conducted to attract as many voters as possible.

Moreover, Jeremy Corbyn has already called on everyone who does not want Brexit to vote for the Labor Party. But Boris Johnson clearly expects an increase in the number of deputy seats for his party members, otherwise, he would not have started the election.

So far, Brexit can be officially considered to be paused only when the results of the vote became known, and it will be possible to understand in which direction the political forces will move the country and to which Brexit at all.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. An unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline.

Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument.

Now, I recommend looking in the direction of sales after a successful attempt to break through the level of 1.2812.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom