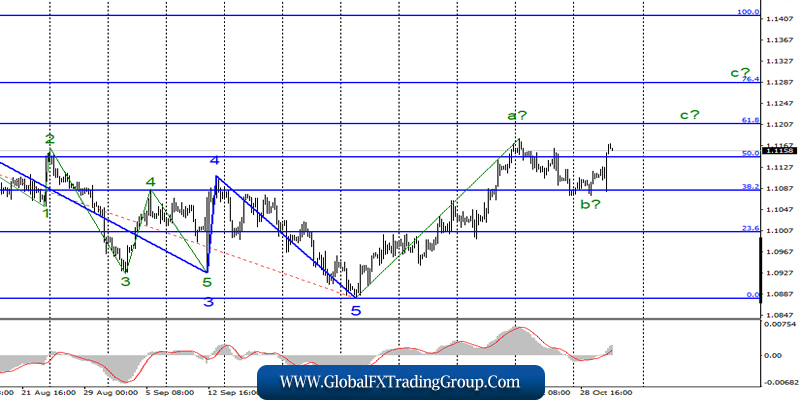

EUR / USD

October 30 ended for the pair EUR / USD with an increase of 40 basis points. Thus, the alleged wave b, after the third unsuccessful attempt to break through the 38.2% Fibonacci level, is still considered completed.

If this assumption is correct, then the increase in quotations will continue with targets located about 12 figures or higher, in the framework of constructing the proposed wave c.

So far, the euro can continue to rise, as it has the corresponding news background, but one should not forget that the EU economy is also experiencing problems and as they “flow out”, the demand for the Euro currency in the currency market may begin to fall again.

Fundamental component:

The news background yesterday came down, by and large, to the evening meeting of the Federal Reserve System and its results as well as the speech by Jerome Powell at a press conference.

Therefore, all the economic reports that came out during the day in America did not really interest the markets. Although, for example, according to preliminary estimates, the level of GDP in the third quarter was higher than the markets expected, + 1.9%.

In addition, the value of the ADP report on changes in the number of people employed in the US private sector was not disappointing, + 125,000. In the evening, the Fed lowered its rate by a quarter point, and Fed Chairman Jerome Powell said that he would continue to adhere to the policy of responding to economic reports.

The Fed, in turn, will pay particular attention to the state of the labor market and inflation. It is also reported that by mid-2020, the Fed may revise inflation targets, as it has not been able to achieve them for a long time.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward wave set and has completed the construction of wave b. I recommend buying the instrument now, since the construction of the proposed wave with has begun.

Its goals are located near the estimated levels of 61.8% and 76.4% Fibonacci, which is equivalent to 1.1208 and 1.1286. A MACD signal “up” is also received.

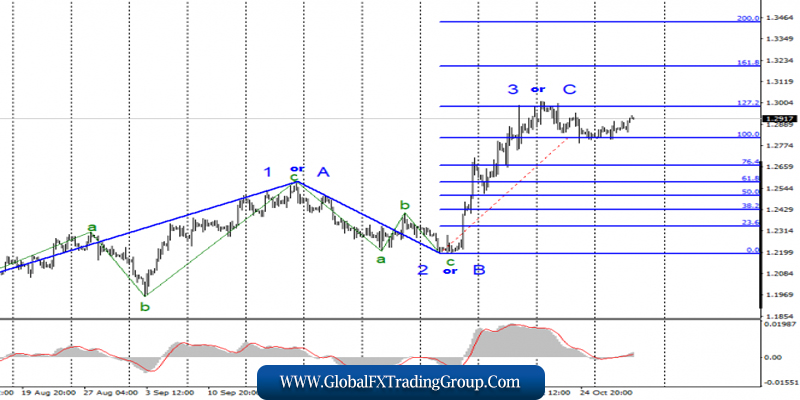

GBP / USD

On October 30, the GBP / USD pair gained about 40 basis points, however, in the case of this instrument, it is impossible to say with confidence that the construction of the upward trend section will resume.

The pound-dollar pair also completed a series of unsuccessful attempts to break through the Fibonacci level of 100.0%, which indirectly indicates a willingness to build a new rising wave, but the news background in the next month may or may not be on the side of the pound, or may be absent.

Thus, it is not a fact that the demand for the pound sterling will remain high, but the markets will actively buy this currency in anticipation of the parliamentary elections scheduled for December 12.

Fundamental component:

Yesterday, Jeremy Corbyn made an attempt to remove even the slightest possibility of holding Brexit by Boris Johnson before the election on December 12.

Formally, Prime Minister Johnson still has the opportunity to implement Brexit, because if the elections are held on December 12, then Parliament should be dissolved 5 weeks before, that is, November 4.

Accordingly, until November 4, Johnson can at least vote on his deal with the European Union at least everyday Of course, the position of the majority of the deputies is unlikely to change from this. Nevertheless, there is still a ghostly chance. However, the Parliament blocked the postponement of the election date by December 9 by a majority of votes.

Thus, the next three days will be interesting in terms of finding out if Boris Johnson will try to push the deal through Parliament again. If not, then no reports will be received from the British Parliament from November 4 to December 12, and all the country’s political parties will focus, perhaps, on the most important elections for the country over the past few decades.

After all, the fate of Brexit will depend on who wins the election (and how many deputies will be represented in Parliament).

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument.

Now, I recommend looking in the direction of sales after a successful attempt to break through the level of 1.2812.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom