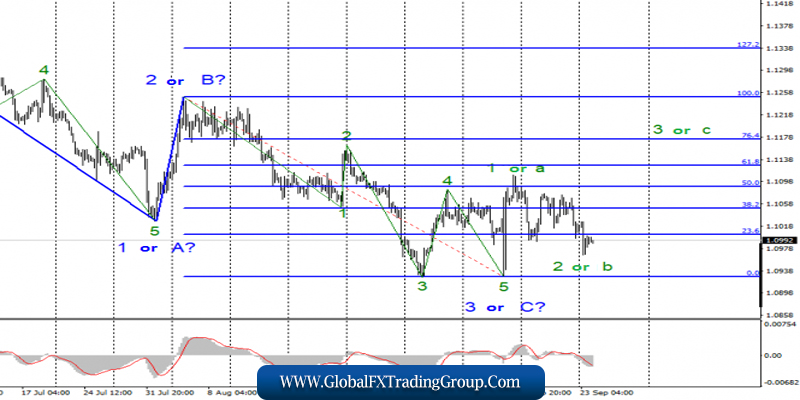

EUR / USD

Monday, September 23, ended for the EUR / USD pair in a decrease of 25 basis points, although the losses could have been much larger. Business activity in the manufacturing and services sectors of Germany and the European Union was much worse than market expectations.

Not a single index that exceeded the forecast. Thus, the current wave pattern has undergone some changes, and the alleged wave 2 or b has taken on a pronounced three-wave form.

Based on this, I still expect to build a rising wave with, however, with each new decrease of 10-20 bp, the instrument is approaching the resumption of building a downward trend section. In this case, the trend section between September 3 and 13 will be treated as corrective, and from September 13, it turns out, a new impulse wave began to build.

Thus, a successful attempt to break through the minimum of the alleged wave 3 or C will indicate the readiness of the markets to build a new downward trend. Fundamental component: We can not say something separately about the performance of Mario Draghi yesterday.

Markets, of course, did not expect anything good from the head of the Central Bank, who had only recently announced a powerful easing of monetary policy, but wondered how much this time would be a “dovish” statement by the ECB chairman.

And as usual, Mario Draghi “did not disappoint.” He said that the EU’s economy is experiencing problems, and there’s no question of its recovery now. The slowdown in business activity in industry could negatively affect other sectors of the economy, as trade wars still negatively affect the EU’s economy, and inflation remains at a very levels. In addition, Draghi noted that the ECB is ready to continue to cut rates and use all the available tools to support the economy.

Purchase goals:

1.1128 – 61.8% Fibonacci

1.1175 – 76.4% Fibonacci

Sales goals:

1.0927 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has resumed the construction of wave 2 or b as part of a new section of the trend, originating on September 12. This wave risks transforming into a new bearish with adjustments to the whole wave picture. I recommend buying a pair with targets near the calculated levels of 1.1128 and 1.1175 calculated on the construction of wave 3 or with a MACD signal “up”.

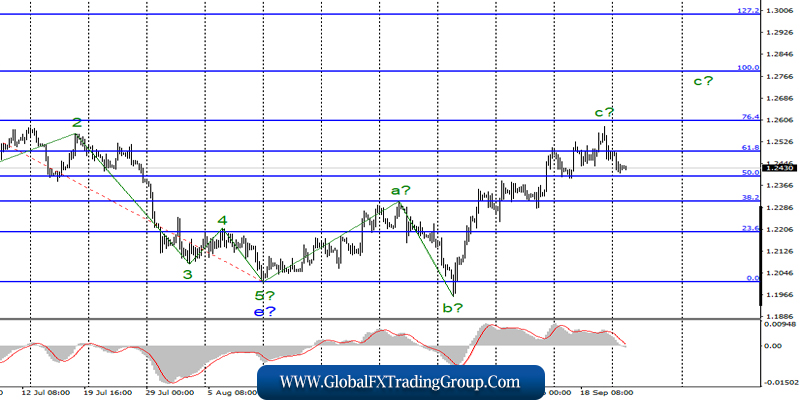

GBP / USD

On September 23, GBP / USD lost another 40 basis points, as business activity indices in the US manufacturing and services sectors were slightly higher than the expectations of the foreign exchange market. Thus, the instrument is getting closer and closer to completing the construction of the proposed wave c as part of the correctional upward trend section.

On the other hand, the flow of encouraging news from the UK has probably dried up. In recent days, the market has not received anything optimistic from Britain. Perhaps, this explains the decline in quotations in the last two days.

However, today, the long-awaited good news may come from London, where the Supreme Court of Great Britain is to pass a verdict in the case of the suspension of parliament. If a court decision is made in favor of the plaintiffs, and it will be positive news for the pound, as MPs will soon be able to get back to work and continue to oppose the Brexit without a deal, which continues to push all sorts of ways Boris Johnson. Fundamental component:

On Tuesday, September 24, the UK economic news calendar is empty again. Thus, all the attention of the forex currency market will be riveted today to the decision of the Supreme Court and possible new information from the Prime Minister. It is this information that can bring the British currency back to life.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2602 – 76.4% Fibonacci

1.2784 – 100.0% Fibonacci

General conclusions and recommendations:

The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the calculated levels of 1.2602 and 1.2784, which corresponds to 76.4% and 100.0% Fibonacci. Wave c could also complete its construction, however, the MACD signal up can still be used for new instrument purchases.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom