EUR / USD

Tuesday, September 24, ended for the EUR / USD pair with an increase of 20 basis points. However, the instrument went down exactly the same this night and in the morning.

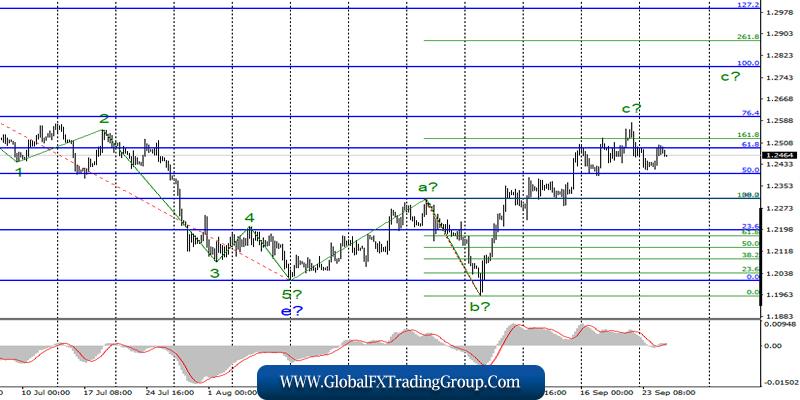

Therefore, the expected wave 2 or b as part of a new upward trend section has the last chance to complete its construction. If there is another successful attempt to break through the minimum of this wave, then the entire wave pattern will require adjustments, and the trend section will transform into a bearish one.

The news background is still the main opponent of wave marking, which involves the construction of an upward trend section. The news for the euro-dollar pair is either disappointing or not. Yesterday was the second option, the pair rose slightly, but, as we see today, it has already managed to drop, although the news background is still missing.

Fundamental component: In this situation, it remains only to rely on the fact that markets will not continue to sell the instrument. That is, hope for the markets to ignore the general news background or hope to receive positive information for the euro currency in the near future.

Unfortunately, there are no other options. After the markets witnessed a new “encouraging” performance by Mario Draghi, the euro is difficult to expect a more or less tangible increase again. “Stunning” business activity indices in services and production in Germany and the European Union perfectly complement the overall picture of a “chic” news background for the euro / dollar pair.

Purchase goals:

1.1128 – 61.8% Fibonacci

1.1175 – 76.4% Fibonacci

Sales goals:

1.0927 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed waves 2 or b as part of a new trend section, which originates on September 12. However, this wave runs the risk of transforming into a new bearish with adjustments to the entire wave pattern.

I recommend buying the instrument in very small volumes with targets near the calculated levels of 1.1128 and 1.1175 calculated on the construction of wave 3 or s, but with a mandatory stop under the current low of September 23.

GBP / USD

On September 24, the GBP / USD pair gained about 60 base points, which was exactly the reaction of the markets to the verdict of the British Supreme Court in the case of the suspension of Parliament.

The court fully and unanimously admitted that Boris Johnson had violated the law when he sent Parliament to “rest” for 5 weeks, while normal practice involves the dissolution of parliament for no more than 5-10 days in emergency situations. In addition, the court fully understood the case and ruled that the decision of Boris Johnson was connected with the desire to remove the deputies of the Parliament from the case so that they would not interfere with the implementation of the tough Brexit and could not hold the government accountable.

Thus, the suspension of the Parliament recognized as illegal and invalid. Already today or tomorrow, deputies will be able to return to work. The pound, in turn, added a little paired with the US currency, as this news is regarded by the Forex market as positive.

Any news that pushes the hard Brexit away is considered positive and any news of Boris Johnson’s failure to implement plans deflects a tough Brexit.

Fundamental component:

On Wednesday, September 25, the UK economic news calendar is empty again, as is the US calendar. Thus, today, I am waiting for news from the Parliament of Great Britain, which should return to work. I am also waiting for the leaders of the opposition to speak in order to understand possible actions against Boris Johnson in the near future. It is no secret that far from everyone is satisfied with the Prime Minister in the Parliament, which he dismissed.

In the near future, we can expect a vote of no confidence in Johnson, which calls for resignation voluntarily. However, Johnson is unlikely to leave his post voluntarily, but every such event and the opposition cast an ever greater shadow on the Prime Minister. All this will positively affect the pound.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2602 – 76.4% Fibonacci

1.2784 – 100.0% Fibonacci

General conclusions and recommendations:

The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the calculated levels of 1.2602 and 1.2784, which corresponds to 76.4% and 100.0% Fibonacci. The wave c could finish its construction, and thus, I recommend waiting for a new successful attempt to break through the 61.8% Fibonacci level for new purchases of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom