EUR / USD

Wednesday, September 25, ended for the EUR / USD pair with a decrease of 75 basis points. There were no important news and economic reports yesterday, but this did not save the euro from a new decline.

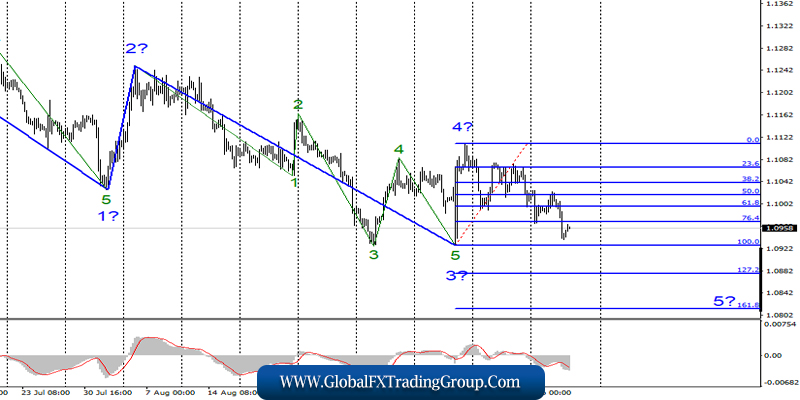

Thus, since the wave originating on September 13 has become too complicated, I conclude that it is a new impulsive bearish wave 5. In addition, the entire trend segment, originating as early as June 25, was transformed into a five-wave one.

If this is true, then the instrument will continue to decline to the level of 100.0% Fibonacci from current positions. Further dynamics of the euro-dollar pair will depend on the news background, which remains, to put it mildly, not in favor of the euro.

Fundamental component:

The latest news regarding the euro-dollar pair relates to the political scandal in America, which is related to the Democrats’ desire to impeach Donald Trump in connection with his possible pressure on Ukraine to investigate the activities of Trump’s main rival in the 2020 elections, Joe Biden.

For several days in a row, the media and markets discussed this topic, but it all ended with the fact that Trump provided with the consent of the Ukrainian government a transcript of a conversation with Volodymyr Zelensky, which seems to confirm the accusations of the Democrats, but on the other hand, there is no unambiguous pressure on Kiev.

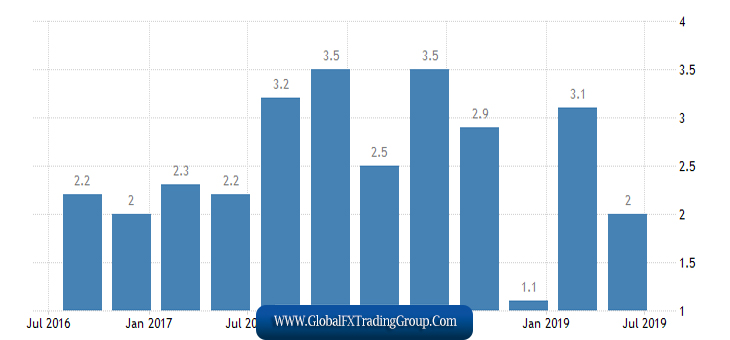

Thus, the topic of impeachment to Trump is interesting, yet more important, from my point of view, is the report on GDP, which will be released today.

In the second quarter, US GDP is expected to grow by 2% compared to the second quarter of the previous year. If the value of the report is higher, then the markets may begin to buy the dollar again.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has transformed the entire wave markup. Now, I expect a successful attempt to break through the minimum of the alleged wave 3 and a further decline in the pair with targets located near the calculated levels of 1.0876 and 1.0814. Wave 5 can turn out to be both very long and shortened. Thus, everything will depend on the news background.

GBP / USD

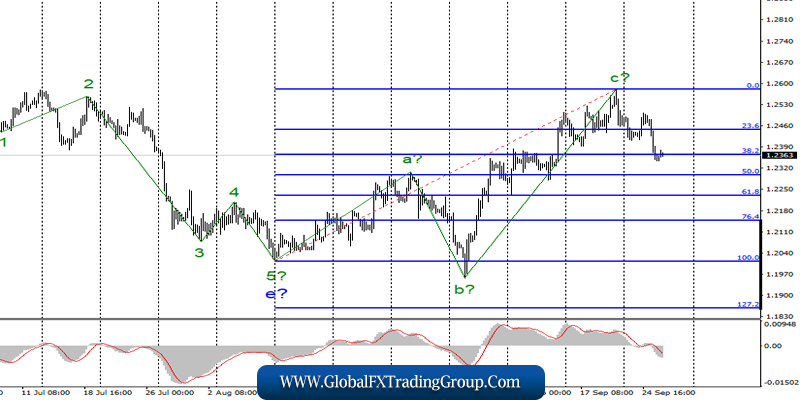

On September 25, the GBP / USD pair easily and simply lost 150 base points despite the fact that the Supreme Court had decided to resume the work of the Parliament a day earlier, which seemed to support the pound. However, wave c having a size of approximately two times larger than wave a, presumably completed its construction, as well as a corrective upward set of waves.

If this is true, then the decline in quotations of the pound-dollar pair will continue as part of the construction of a new three-wave wave structure with the prospect of reaching 20 and 19 patterns. As before, much in the dynamics of the instrument will depend on the news background.

Thus, the Brexit theme remains central to the pound and markets that trade the pound. However, there is still no news regarding Brexit (the Parliament held only the first session after leaving the “vacation”), but today, the statement will be made by the head of the Bank of England Mark Carney, which will undoubtedly cause interest.

Fundamental component:

Today, the UK economic news calendar is empty again, but the second quarter GDP report will be released in America, as written above. I recommend paying attention to it and the performance of Mark Carney, although markets do not expect much from Carney’s performance.

It is unlikely that the rhetoric of the BA’s leader will change to hawkish since there is no reason for this. Most likely, the words about the possible negative consequences of the hard Brexit and the personal fears of the chairman will be heard again.

Such a performance is unlikely to support the demand for the pound sterling. Thus, a new decline in the British currency today is very likely.

Sales goals:

1.2297 – 50.0% Fibonacci

1.2229 – 61.8% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The upward trend section supposedly completed its construction. Thus, now, I expect a decline in the instrument in the direction of the levels of 50.0% and 61.8% Fibonacci. I recommend weak sales of the pound-dollar pair, which should be supported by the news background from the UK and the USA.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom