EUR / USD

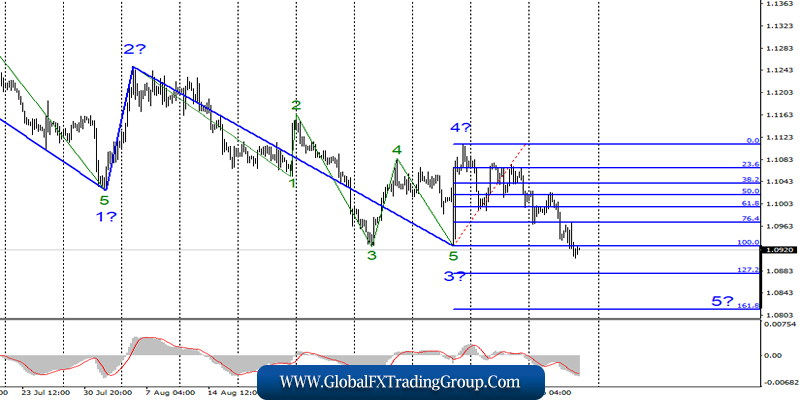

Thursday, September 26, ended for the pair EUR / USD with the loss of another 25 basis points. Thus, a successful attempt was made to break through the lows of waves 3 and 5 , in 3.

The confirmation of the readiness of the Forex currency market to continue building a downward trend section, as well as the wave structure of which has acquired a 5-wave form has been received. If this assumption is correct, then the decline in quotations will continue in the direction of the level of 161.8% Fibonacci.

Yesterday’s second quarter GDP report in America recorded an increase of 2.0%, which was exactly the same how markets expected to see, so there was no euphoria. However, the US dollar continued to increase, despite the fact that there were no other news and reports during the day. The “bearish” mood of the markets is visible to the naked eye.

Fundamental component:

News with a possible impeachment to Donald Trump is not too much interesting in the market. The markets are eagerly awaiting the economic reports that will come today from the United States.

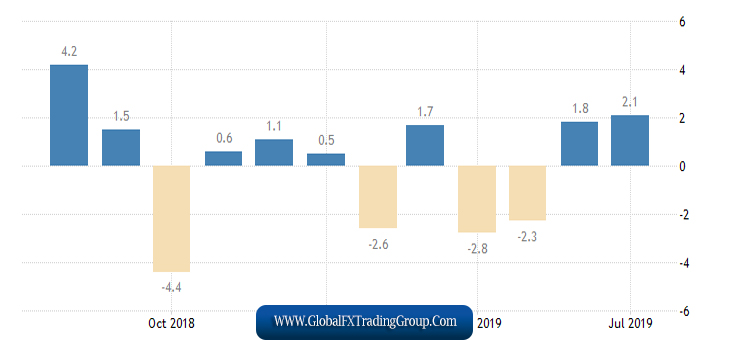

First of all, it is about changing the number of orders for durable goods.

Over the past year, just 4 months ended in the red, the last two showed an increase in orders. Thus, a recession may follow again in August, which is what most forecasts indicate.

A reduction of 1.0% is expected. This indicator has several variations: indicators excluding transport, excluding defense orders, excluding defense and aviation. All of them are also important, and the market reaction will consist of reactions to each of the 4 reports.

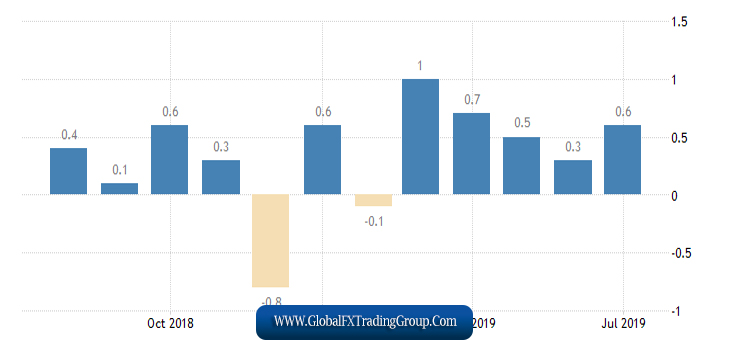

Also today a report on the change in personal income is expected…

… and the personal expenses of the Americans. According to forecasts, the growth rate of personal incomes should grow by 0.4%, and expenditures should be reduced to 0.3%. However, these figures will in any case mean an increase in both expenditures and incomes of the American population.

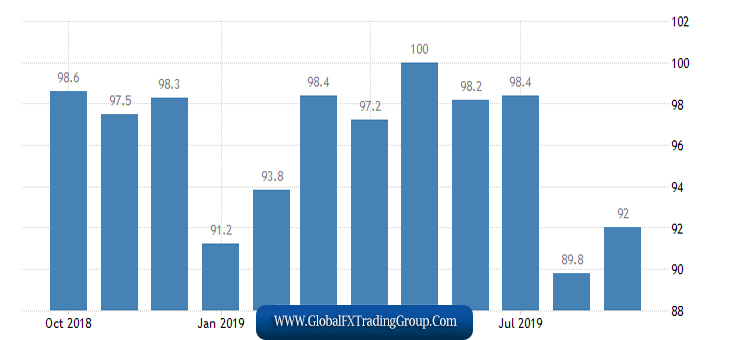

The latest to come is the Michigan Consumer Confidence Index. In the last two months, as you can see, consumer confidence has declined, but still remains quite high. By the end of September, no significant changes in the index are expected.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has transformed the entire wave markup. Now, I expect the pair to continue to decline with targets located near the calculated levels of 1.0876 and 1.0814, which equates to 127.2% and 161.8% Fibonacci. Wave 5, on the other hand, can turn out to be both very long and shortened. Thus, everything will depend on the news background.

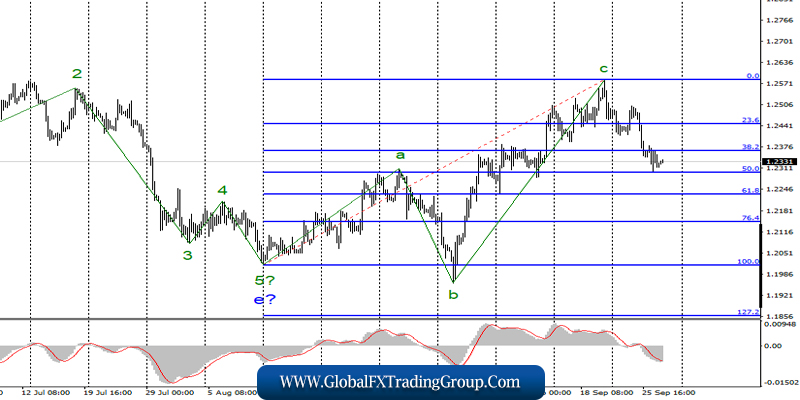

GBP / USD

The pair GBP / USD on September 26 fell by another 25 basis points. Thus, the construction of the proposed first wave as part of a new downward trend continues. The UK news calendar in recent days is completely empty, and markets can only keep track of messages from the UK Parliament, which does not stop being the main source of news.

But, unfortunately, even now, apart from debates and new furious calls by Boris Johnson to support Brexit until October 31 or early elections, no one is taking place. Meanwhile, debate over the possible resignation of Donald Trump continues in the US.

An investigation into the pressure on Kiev has been launched because of Trump’s desire to investigate the activities of his main rival in the fight for the presidency in the upcoming elections of Joe Biden. Thus, in order for the impeachment process to officially start, the support of 218 votes of the House of Representatives is necessary, and it seems that the right number of votes is at the disposal of the Democrats.

The dollar, however, does not really respond to this news. Fundamental component: Today, the UK economic news calendar is empty again. Although, until Great Britain officially leaves the European Union, markets will have an inexhaustible stream of news from the British and European governments, which speak with enviable regularity on Brexit. In addition, there is a huge stream of news from the British Parliament, which continues the confrontation between Boris Johnson and the opposition. Thus, it is these news that I recommend tracking.

Sales goals:

1.2297 – 50.0% Fibonacci

1.2229 – 61.8% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The upward trend section supposedly completed its construction. Thus, now, I expect a decline in the instrument in the direction of the levels of 50.0% and 61.8% Fibonacci. The news background from the UK and economic reports from the USA continue to have the greatest impact on the dynamics of the euro-dollar instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom